Dow: -171.89…

Nasdaq: -0.24… S&P: -16.97…

I sent you out a little note mid-afternoon about the ‘goings-on’ over in Russiaville.

Those headlines turned the market lower, but then, to everyone’s surprise, the jackass President of Ukraine later said he was ‘only being sarcastic’ about Russia attacking on Wednesday. Comedian.

This reminds me of the European Crisis when we saw conflicting headlines almost every hour and the market bounced around like a drunk walking in traffic.

So we are now in a war-based headline market and it’s hard to know who to believe. I believe no one and trust no one in government, but that’s just me. The takeaway though is that we will probably trade all over the place until “peace breaks out” or they go in with howitzers blazing.

Of note today was gold. I mentioned last night that GLD broke above some serious downtrend resistance on Friday. Today, it got a bit of a follow-through higher. Silver (SLV) acted better too and is close to the same type of downtrend breakout. Silver and gold have been hard to trust but maybe now is their time to shine, no pun intended. The close above 1870 on physical gold was bullish.

They have to stay hot though. Lately, I’ve become more of a believer that gold & silver aren’t the store of value or the inflation hedge that they were years ago, but maybe that will change.

Gold (etf)

Silver (ETF)

Crude was up but energy stocks were mostly down today. They needed a break and were a little extended.

Doesn’t sound like we’re gonna crash though……

“The GS Prime book saw the largest net buying since late December (+1.0 SDs), driven by risk-on flows with long buys outpacing short sales 8 to 1. Net flows diverged between Single Names (3rd straight week of net buying) and Macro Products (4th straight week of net selling); suggesting a shift of focus to micro variables. All regions were net bought led by North America (driven by long buys) and to a lesser extent DM Asia (driven by short covers). 8 of 11 global sectors were net bought led in $ terms by Info Tech, Materials, Financials, and Consumer Disc. Net buying in US Info Tech continued this week” (GS prime brokerage).

Goldman is a criminal enterprise but they’re good with those factoids.

A lot of nice charts aren’t doing what they are supposed to right now, but that will change when the market finds some footing.

But higher rates and the potential for even higher rates have everyone worried about growth prospects and earnings going forward, so it’s a much tougher market.

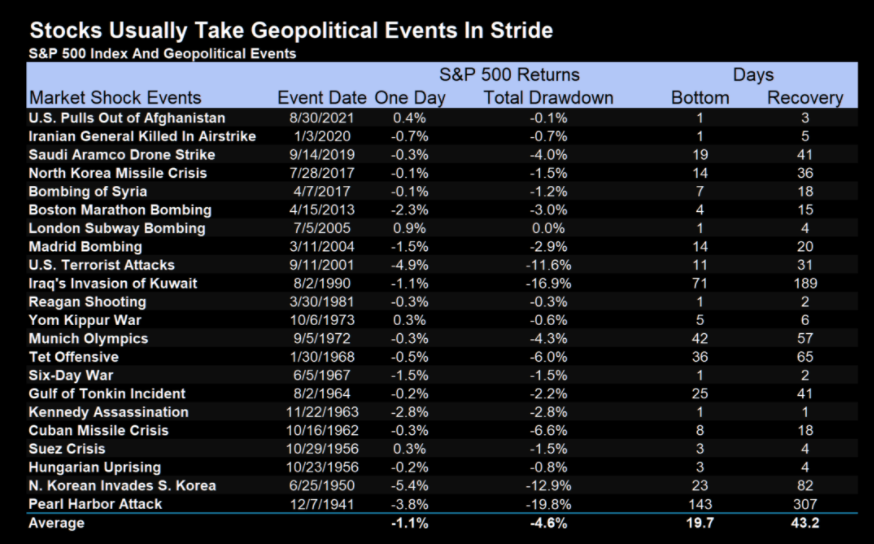

Wars and markets…………………………..

P&L here

See you in the morning.