Friday

Dow: -503.53…

Nasdaq: -394.49… S&P: -85.44…

YTD

Dow -4.4% YTD

S&P 500 -7.3% YTD

Russell 2000 -9.6% YTD

Nasdaq -11.9% YTD

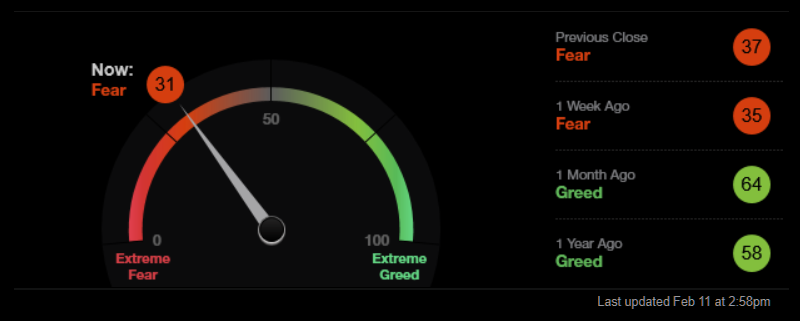

The S&P 500 fell 1.9% on Friday amid burgeoning fears of a Russian invasion of Ukraine. The Nasdaq underperformed with a 2.8% decline while the Dow (-1.4%) and Russell 2000 (-1.0%) fared slightly better than the S&P 500.

PBS reported in the afternoon that the “U.S. believes Russian President Vladimir Putin has decided to invade Ukraine.” National Security Advisor Jake Sullivan clarified that the White House doesn’t think President Putin has made a final decision, but he did acknowledge a “distinct possibility” that Russia could invade Ukraine before the end of the Olympics.

The market, which was trading mixed, took a spill following the news with the mega-caps leading the retreat. The S&P 500 sliced through its 200-day moving average (4452) on closing basis with little interest to buy the dip given the uncertainty heading into the weekend.

Nine of the 11 S&P 500 sectors closed lower. The energy sector rose 2.8% as oil prices climbed back above $93 per barrel.

The Nasdaq couldn’t look worse right now and is back underneath all key moving avaerges. Its seems that when the sellers show up they go out of their way to lean on tech.

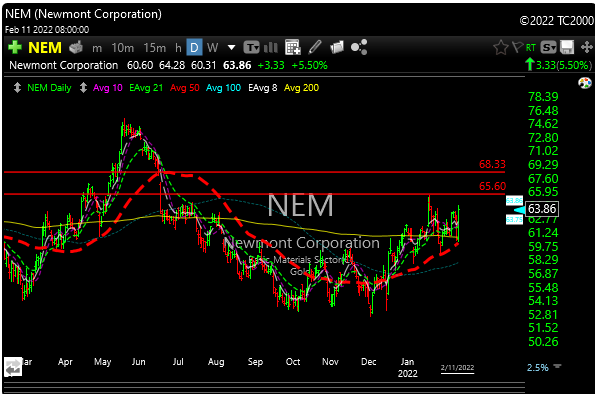

You know we have been watching gold (GLD). Well it finally broke out of that wedge and above downtrend. Weve been faked ot before, but will bear watching next week.

Crypto caught an oversold bounce last week but still hard to trust at least for now. I like MARA which I mentioned last week and had a great week. Trade carefully with tight stops if you play.

Also, BTU was higlighted last weeknd. Raise stops is you played.

As you may have decuced by now, I am showing you more names during the week. Many dont go on the P&L but they are solid setups and are actionable in my opinion, so keep an eye on those stocks as well. If you have questions on levels on these names just shoot me an email.

Setups

NEM– Premier gold name that should lead if gold can continue. Strong bullish engulfing day, watch for continuation. I like GOLD too in gold space.

GFI– Another gold play with a nice setup Targets 12.5-14.00

VSCO– You all know this one. The spin of from L Brands. NIce base. Possible move to high 60’s

TECK– Mentioned a few times, watch for continuation.

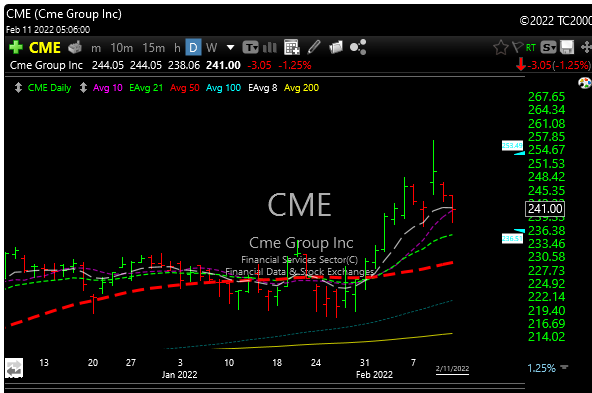

CME – I like it here but like it more on a little pullback to the 235 area. This is where they all go to buy commodities and inflation protection.

ANDE– has been bouncing around within the confines of a bullish wedge. Once through 39.40 and 40.40 target is 44-45.

I’d like a little pullback in some of the energy and agriculture names. They look fantastic.

P&L here. See you in the morning.

Rams -4.50, but what do I know. Enjoy the game.