{+++}

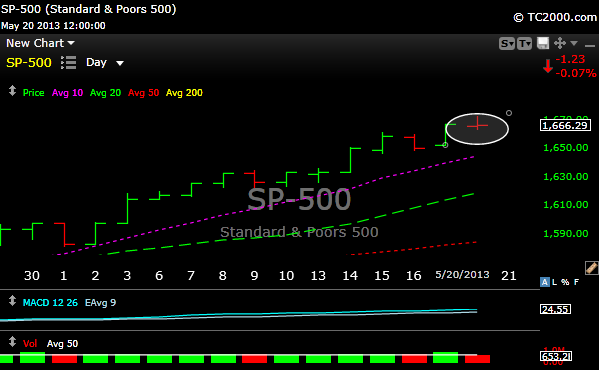

Some folk are talking about market tops again. Who can blame them? They are referring to the “doji” candle on the SPX today (circled below). Sometimes this represents some market indecision which may mean a trend change. Remember its the next day that is more important, and not what happened today. I say balderdash for now.

Today we saw triggers in: RVLT (traded sloppily), SLB, ALKS (also sloppy), ACAD and FURX. Most of you newer traders are taking my advice about staying away from the first 30 minutes or so. It’s a good discipline. Its very tempting at the open because you’re all jacked up and ready to go, but many times you will get a bad price. In the case of AMBA, you could have bought the opening trigger at 16. and it worked, many times it doesn’t. Anyway, I did trigger it for the salty veterans because a lot of you guys bought it. If you didn’t get long, wait for a pullback to the 16 area to enter, or I will give you some input on when to get involved.

I’m a stickler about this because it has happened to me many times. If you have a very well funded account it doesn’t matter. However , if you have limited buying power and you chase a stock that opens up a buck, or runs a buck right away, and it rolls right back down, well on 1000 shares, maybe your down 800 bucks and you spend the rest of the day trying to get even, and with limited capital, that can lead to other problems, like revenge trading. OK that’s my rant for the evening. Because we are in bull mode and this may happen a lot, I will try a tell you in the morning if it makes sense or not to buy early.

Have a great night and I’ll see you in the chat in the morning. Check the P&l as I have adjusted some stops again.