Back in early April I talked about a breakdown in the refiners. Well they broke down, some were good for a quick 10% trade lower from the short side. Here is the original post for reference.

Anyhoo, the refiners are starting to look better after their correction, so you may want to tale another look, this time from the long side. Everything is trade. I will review the same stocks that I talked about in the April post in the same order.

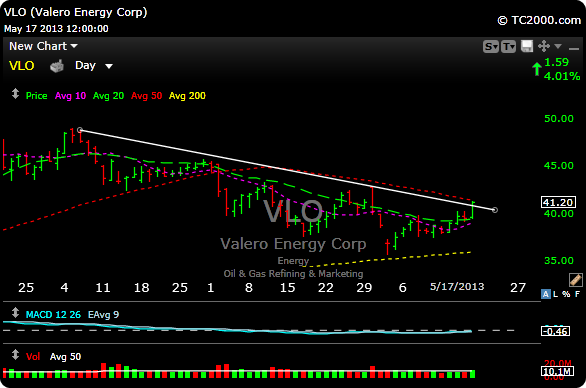

$VLO– Was a good short down to the 200 day simple moving average, where it found support (yellow line). As you can see, it bounced and is moving higher again. It had a bullish day on Friday as volume improved and MACD is trying to turn up. It close slightly above its 50 day moving average (red line) which also happens to be right around where its downtrend line is (white line). A move above the 41.50 level with volume could break this one out again.

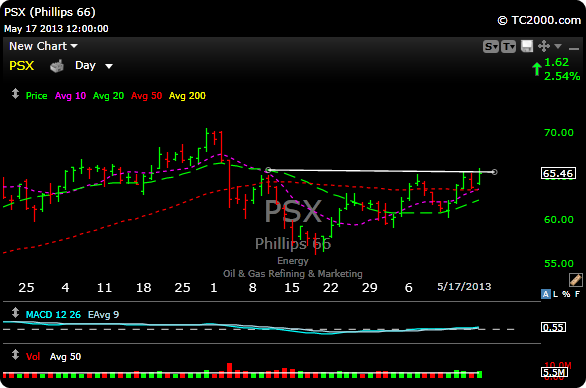

$PSX – Is at lateral resistance and could get going again on a move above 66 with volume.

$TSO -Had a massive high volume breakout on Friday, so watch for a continuation higher, although I would not chase this one as it has already broken out. Wait for a pullback or just let t go.

$WNR– As you can see WNR had a massive head and shoulder pattern, broke the neckline, bear flagged and went even lower. It did find support at its 200 day moving average (yellow line) twice (double bottom?) and bounced hard. Those 200 day levels can be magic, I use them all the time for really good support and resistance levels. Anyway, if this one can get above the 50 day moving average (red line) which is around 32.75, it could get going to the upside again.

Hope you found this update helpful.

Subscriptions here.