{+++} I’m not getting all goofy and “beared up” yet, because one day does not a trend change make. However, we were very overbought according to the McClellan Oscillator and Ned Davis research showed an extreme reading on investor sentiment yesterday. Bottom line, everyone was too bulled up. It’s OK to be bullish, that’s why God invented stops.

Where we go tomorrow is anyone’s guess. The bears could press things lower or the bulls (dip buyers) may reemerge.

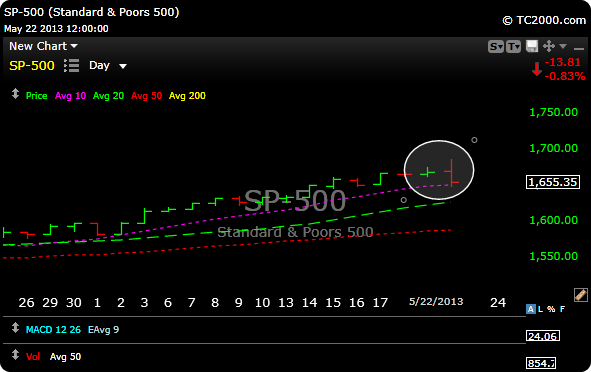

You’ve heard me talk about bearish engulfing candles. Some of you may not know what it is. Basically its when the high and low for today, is higher and lower than the high and low for the day before. So today’s candle basically engulfs the prior day. It can be bearish and it can imply a reversal of a trend and the beginning of a change of direction. Same goes for bullish engulfing candles. You can see what it looks like below. This pattern occurred on all the major indexes today. The Russell 2000, The Dow and the Nasdaq.

The good news is that the SPX held its 10 day moving average support. I thought that might hold and it did for now. If that level doesn’t hold in the coming days,then there is a shot that we go down and test the 20 day moving average around 1627.

I added MSTR as a short today and I have updated the P&l, so please review it this evening.

Tomorrow could be a big day so get some rest. See you on the chat in the morning.