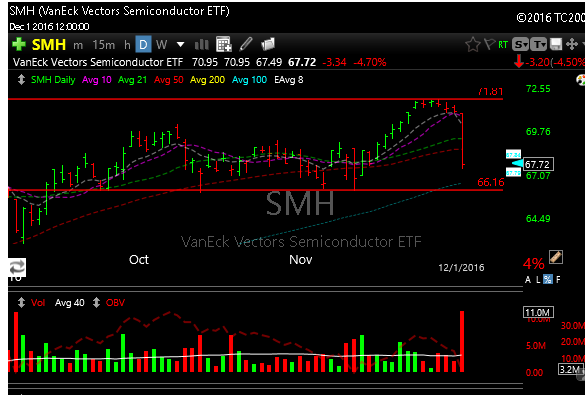

Look what the semiconductors did today. Ugly. A massive rejection at resistance. As a result, this helped the Nazzy take another shot to the bow of the boat today.

Lately I feel like I’m tip toeing around land mines. Yes the Trump rally has been good, but only for certain areas. Things are starting to spin like a dreidel on methamphetamine as we sector rotate our faces off here.

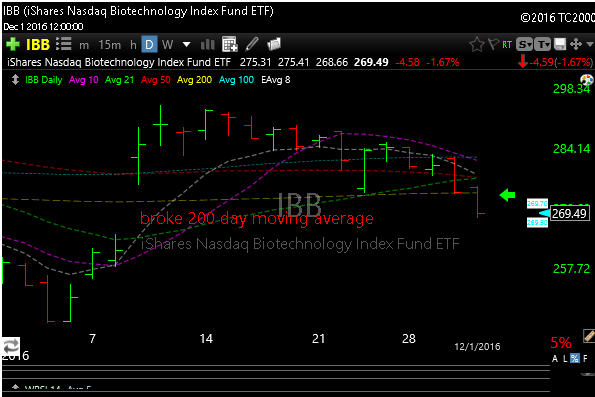

Adding to the Nazzy woes is biotech. Yes, there are a lot of biotech names in the Nazzy. Today, IBB broke its 200 day moving average. It looks like 265 is the next target.

How about those FANG stocks? FB, AMZN, NFLX and GOOG? They are all breaking down and hard.

So what to do???

This is a tough one. You can “buy weakness” in tech, but risk getting blown up, or you can chase whats working. I don’t like chasing and I don’t catch knives (tech is a falling knife right now), until the technicals turn, so its tough right now.

The idea is to buy what IS working, but wait for better levels. It’s OK to focus on energy and infrastructure and maybe banks with the idea that you will buy them cheaper as everything Is stretched.

When things get silly like this, cash and smaller positions is always the best place to be. This may be challenging for a couple f weeks until everything settles and just works off all the overbought conditions. Tech isn’t dead, its just in time out.

As I said last night things probably get a little more challenging here. Sometimes you can make more money in a tough environment like this though. Stocks get overdone to the upside and the downside and great opportunities emerge both long and short. Moving forward I like this kind of action. I’m starting to see phenomenal setups emerge.

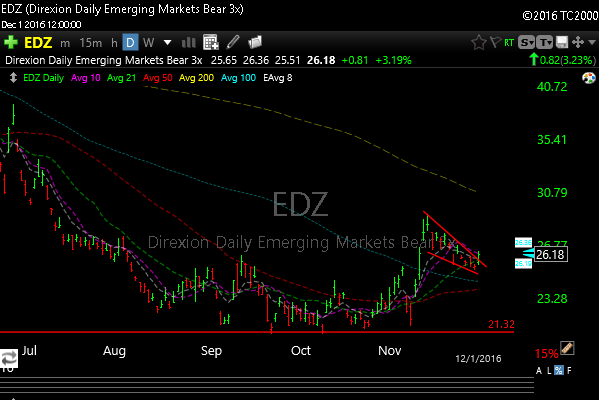

I added TZA and EDZ today. Why did I do that?

The Russell as been down 3 of 4 days now and it looks toppy. A 3-4% pullback would be healthy so I am long TZA which I think has a reasonable risk/reward. If TZA takes out Mondays lows we are out of the trade, if the technicals worsen on the Russell though we could see nice upside. This is more of a trade for right now and not a big directional bet on the Russell or the overall market in general.

I added EDZ long today. EDZ is the leveraged etf that gets you short EEM or emerging markets.

EEM has almost an identical chart setup as EWZ. EWZ is Brazil, and it folded like a lawn chair today. I’m hoping for the same fail in EEM short term.

Check out that beautiful wedge snap on EEM today

See you in the morning.

Non members can subscriber here