Dow +477.75 at 39760.08, Nasdaq +83.82 at 16399.52, S&P +44.91 at 5248.49

Today’s trade had a positive bias. Advancers led decliners by a 9-to-2 margin at the NYSE and by a 5-to-2 margin at the Nasdaq. The upside moves were driven by an ongoing inclination to buy on weakness following yesterday’s afternoon slide.

Some normal consolidation activity in heavily weighted names kept a limit on index gains in the early going. By the close, though, many stocks were participating in upside moves, sending the major indices sharply higher. The market ultimately closed at or near session highs, which had the S&P 500 at a fresh all-time high.

Meanwhile, the Russell 2000 continued its recent outperformance today, climbing 2.2%. The small-cap index benefitted from strength in regional bank stocks, which also boosted the SPDR S&P Regional Banking ETF (KRE) (+3.7%). Other bank stocks outperformed, too, as evidenced by a 3.2% gain in the SPDR S&P Bank ETF (KBE).

On a related note, the S&P 500 financial sector jumped 1.2%. Eight of the 11 S&P 500 sectors gained more than 1.0% from yesterday’s close. The rate-sensitive utilities (+2.8%) and real estate (+2.4%) sectors were the top performers, responding to a drop in yields.

Setup

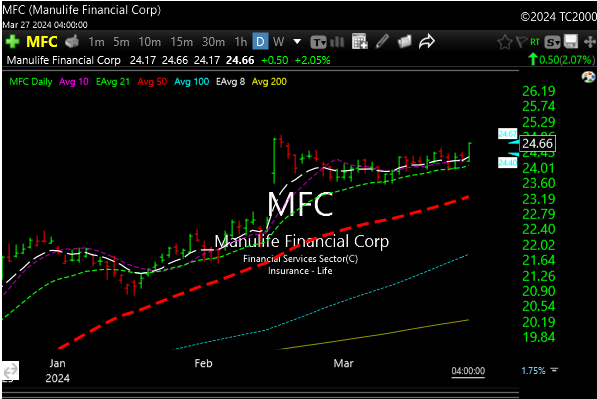

MFC– Triggers at 24.90. Stop 23.70

Check P&L for adjustments/updates.