“1984” was not supposed to be an instruction manual.

Dow -198.77 at 33402.29, Nasdaq -63.13 at 12126.33, S&P -23.91 at 4101.87

The market was pressured by signs of a slowing economy after weak factory orders and JOLTS reports.

The Job Openings and Labor Turnover Survey (JOLTS) showed a slowing labor market, with 9.931 million job openings in February, lower than views of 10.4 million. The number fell from 10.824 million in January. Jobs fell below the 10,000 mark for the first time since May 2021.

Crude oil stalled at $80.41 per barrel after Monday’s big rally.

Gold futures settled $37.80 higher (+1.9%) to $2,038.20/oz after this morning’s JOLTs data came in weaker than expected, which in turn pushed yields and the greenback lower.

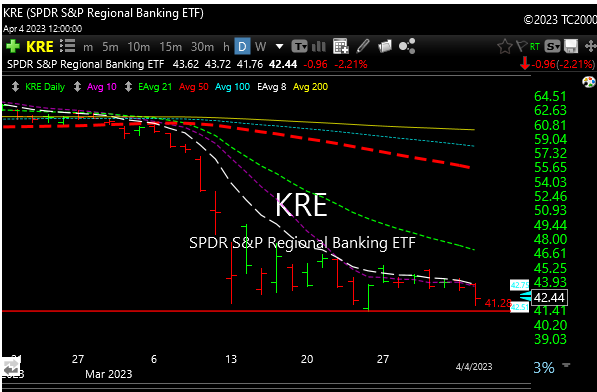

Not even a dead cat bounces in the banks. Feels like a size 17 Bozo the clown shoe is about to drop.

BKX

KRE

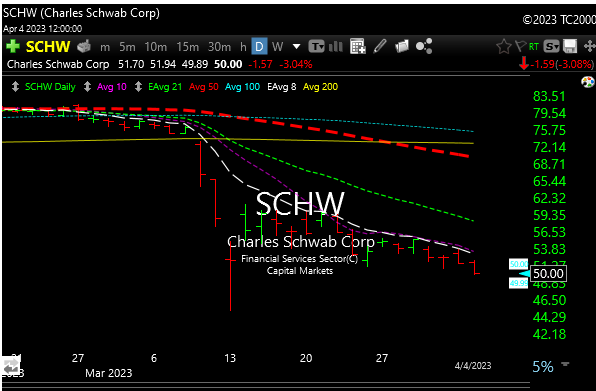

Hearing that TD Bank (TD) is now the most shorted bank. TD is also the largest shareholder in Schwab (SCHW) which trades horribly.

I told you a couple/few weeks ago that Nazzy should run based on the perception of lower rates. It popped by about 7.5%. I think it needs to chill and could even give back some here. A big part of that move was in a small number of stocks so the pays to be cautious.

Yesterday Yuan became the most traded currency in Russia. Today Malaysian Prime Minister has called for an “Asian Monetary Fund” to stop reliance on the U.S. Dollar.

There are some serious global issues out there and I’m waiting for Europe to get unglued.

See you in the morning.