Friday

Dow -384.57 at 31861.89, Nasdaq -86.76 at 11630.51, S&P -43.64 at 3917.91

YTD

Nasdaq Composite: +11.1% YTD

S&P 500: +2.0% YTD

S&P Midcap 400: -2.3% YTD

Russell 2000: -2.0% YTD

Dow: -3.9% YTD

History rhymes: On this day of March 19th in 2008, the 85-year old bank Bear Stearns was bailed out by JP Morgan and The Federal Reserve at $2 per share. Exactly 15 years later, 167-year old bank Credit Suisse goes kaput.

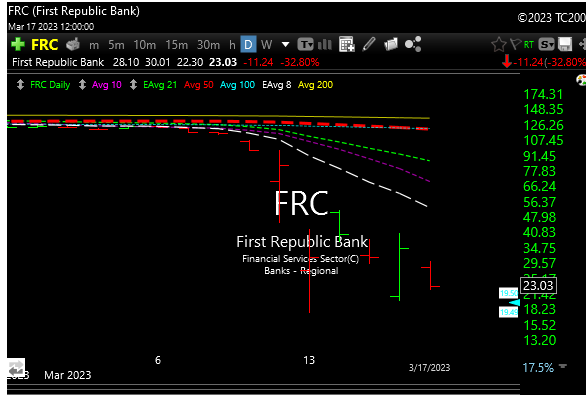

Friday’s quadruple witching options expiration day had a risk-off mentality due to ongoing pressure in the banking sector. Thursday’s better finish was largely a relief rally following news that First Republic Bank (FRC ) had received cash infusions from 11 big banks totaling $30 billion. The relief from that news was short lived and investors sold FRC again on Friday after it provided a cash position update and suspended its dividend.

Over the weekend, UBS reportedly agreed to buy Credit Suisse for more than $2 billion, according to multiple reports. Bank contagion fears are high in the U.S. and Europe. The Federal Reserve meeting looms with the rate hike outcome and outlook very much in flux.

Banking regulators have been given evidence that as many as 25 mid sized banks must be merged/face elimination because of balance sheet issues. Large banks like JP Morgan would be natural buyers if govt relaxes deposit limits. By contrast 1200 banks went away during thrift crisis

The Fed’s Tuesday-Wednesday policy meeting will try to balance banking woes with fighting inflation. Fed funds futures have swung wildly over the past week, but markets currently are leaning toward a modest rate hike.

Bandaids flying everywhere to keep the system from falling apart. Not real sure this stuff is close to over yet.

Meanwhile hated Bitcoin is ripping since the new year started. Maybe because the planet has temporally lost all confidence in the banking/monetary system?

For now, technology, the perceived best beneficiary of lower rates, continues to be a temporary hiding spot. Nazzy had a good week, not so much for the rest of the indexes or sectors.

It will be an interesting Fed meeting this week. A 25 basis point increase seems to be bakes in the cake. What happens in the meetings after that will be of the most concern.

If this banking crisis doesn’t improve, we could see some emergency “cuts”. And that might not be a great thing because it could telegraph that we are more screwed than people think.

Interesting times. I have to be honest. I never saw a bank blowups coming. Next week is a coin flip.

Member and buddy Dave B. sent me this over the weekend. He hits the nail right on the head.