More like a middle finger

The major indexes fell sharply Wednesday morning as Treasury yields and the dollar rebounded, but the stock indexes rebounded to close only slightly lower.

The market rally attempt tumbled in the morning, but the major indexes came well off session lows, briefly turning positive before fading for slim losses.

The Dow fell 0.1%. The S&P 500 index dipped 0.2%. The Nasdaq declined 0.25%. The small-cap Russell 2000 lost 0.6%

U.S. crude oil prices rose 1.4% to $87.76 a barrel, extending strong weekly gains. OPEC+ agreed to cut production quotas by 2 million barrels, at the high end of expectations heading into Wednesday’s meeting.

The 10-year Treasury yield jumped 14 basis points to 3.76%, erasing most of this week’s losses.

So treasury yields were up and the dollar rebounded 1.0% As I’ve been saying, the market needs these down not up.

However, in the face of a strong dollar and higher rates, crude and energy stocks outperformed.

Bullish possibilities……

September is the ugliest month of the year seasonally (played out) but fortunately for bulls, October is on average much stronger. During typical years, it is the 4th strongest month of the year, but over mid-term years since 1950, it is the strongest.

With the dip being bought today and some major reversal setups on the daily charts bulls do have the setup to run a little more.

I’m still not trusting or rushing things and this market could do a rug pull at any point. We saw some of this in the first 90 mutes of trading today.

Here are some potential additions to P&L if triggered.

Some great charts below but we all know great charts can disappoint, so play carefully and maybe a little smaller than your normal size until we get some direction that we can trust.

They have been added to P&L and will be updated with stop areas upon triggering.

*****************************************

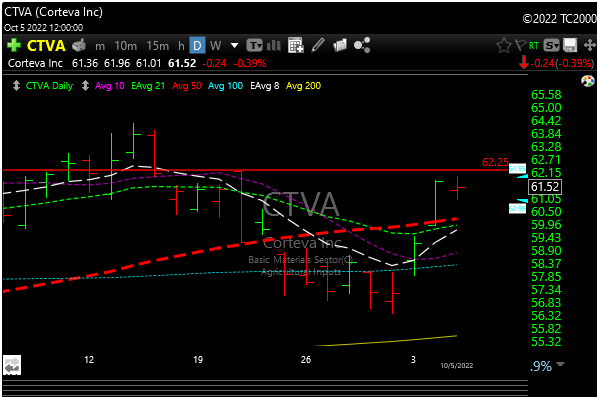

CTVA– over 62.25

CF– over 106.50

VRNA– over 11.05 (biotech so riskier)

SANM– over 50.25

CEIX– over 72