The bleeding continues on this weekly options expiration day.

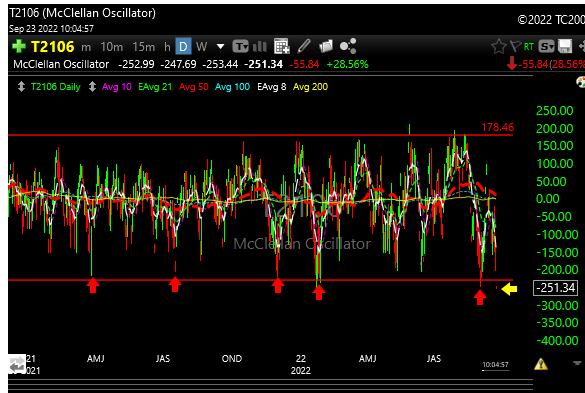

The McClellan Oscillator is at an extreme oversold reading and this is where the market has bounced in the past. This doesn’t guarantee a rally by any stretch but it’s getting close.

The landscape is bearish, recession, etc and we have headwinds now that we haven’t seen in 10 years, so it has become a different market now.

The dollar continues to run and that is just killing things. Also, treasury rates are running higher again today.

Oil has broken $80 a barrel because global growth concerns and a global recession are really taking root.

Bear market rallies are vicious to the upside and we should get one at some point but the longevity of such a rally will be the question.

The trend is now solidly down and SPX 3200-3400 would not surprise me at all in the months ahead.

September has been true to form as it is historically the worse month for the market.

I really think we need to retest those levels before we can say this bear market is over.

No sector is really safe here and everything is getting stopped. Any new longs will be “trades only” because it’s just too hard to trust the stickiness of any rally.