SPX almost tagged 4000.

It’s another rally that many still don’t believe in. This is the nature of markets. If this continues then FOMO will kick in.

There are still so many non-believers and if you are a contrarian, then you know this can fuel prices even higher.

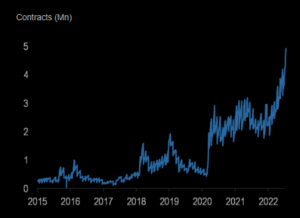

To give an example of the disbelief of it all, VIX call open interest on strikes ≥40 is at record highs. So that means some believe the bottom will still fall out of this market and VIX doubles from here.

I’m wondering if the market smells a Fed pivot. Meaning more dovish than hawkish. The Fed meets next week for the rate decision and there will be a lot of speculation about that number.

Those in the “inflation has peaked/soft landing” camp already think the fed may step on the brakes a little.

I’m not in that camp.

Is the Fed even trying to taper as they promised?

The FED bought $10.9B in securities last week. So they performed QE (easing) while claiming they are performing QT (tapering).

$4 Trillion dollars were printed digitally out of thin air over the past 28 months by the Fed and they haven’t even tried to reduce the balance sheet yet to stop 9% inflation. Hard to believe this ends in anything other than a calamity but buyers are back for now.

SNAP snapped. Gotta be perfect in this market or you get punished pretty hard. Although some companies actually have reported crappy #’s and have been rewarded. Banks, NFLX etc.

I will be scratching my head wondering if we bottomed last month, only time will tell, but all the main indexes are back over their respective 50-day moving averages for 3 straight days now, so it’s a start.

Remember that bear market rallies can be spectacular and fake everyone out.

Good old American Telephone & Telegraph (AT&T to you youngins), said today that customers are taking longer to pay their bills if they pay them at all. This is with historic record low employment, a clear sign that the recession may already be here and will only get worst as inflation continues to destroy purchasing power.

See you in the morning.