“If freedom of speech is taken away, then dumb and silent we may be led, like sheep to the slaughter.” – George Washington

Thursday

Dow: -113.36…

Nasdaq: -292.51… S&P: -54.01…

YTD

Dow -5.2% YTD

S&P 500 -7.8% YTD

Russell 2000 -10.7% YTD

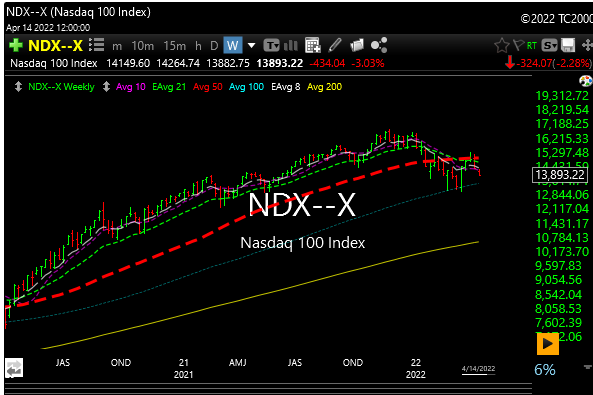

Nasdaq -14.7% YTD

The S&P 500 fell 1.2% on Thursday, slumping into the long weekend as a sharp rebound in Treasury yields weighed heavily on the growth stocks. The Nasdaq underperformed with a 2.1% decline, the Russell 2000 declined 1.0%, and the Dow declined 0.3%.

Influential losses came from the information technology (-2.5%), communication services (-1.8%), and consumer discretionary (-1.6%) sectors, which dragged the S&P 500 below its 50-day moving average (4418) in a steady decline.

The growth/inflation-sensitive 10-yr yield jumped 14 basis points to 2.83% while the fed-funds-sensitive 2-yr yield jumped 11 basis points to 2.45%. The U.S. Dollar Index rose 0.5% to 100.34. Crude futures settled close to $107.00 per barrel ($106.94, +2.69, +2.7%).

So much for April seasonality. It’s supposed to be the best month for the market. I guess you can throw the playbook away when rates are ripping and inflation is running wild.

As Scott Rubner of GS writes: “We estimate a record $2.14 Trillion worth of realized capital gains in 2021, which means a record capital gains tax bill of $346 Billion due on Monday. This tax bill exceeds last year’s prior record of $270 Billion by 28%. This resembles trading activity from 2021. Retail traders saw a resurgence on call option activity during the second half of April after taxes were paid.”

Note that households are the biggest holders of stocks.

So maybe the second half of April will play catch up? We shall see. I just watch volume and price action anyway.

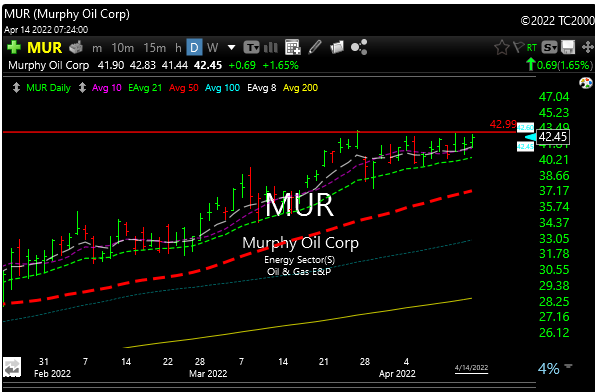

Oil (XLE) and gas names continue higher and coal especially is really outperforming.

Fertilizers (MOO) have run big and may be extended, but they are still holding serve for now.

Financials (XLF) look weak and aren’t living up to the ‘higher rates/higher prices’ theme.

Biotech (XBI) has fallen victim to the “sell growth” theme for now.

Steel (SLX) has run, but the group is coiling bullishly, maybe getting ready for another leg up. I added U.S Steel (X) on Thursday.

Metals & Mining (XME) printed 11 years highs next week.

Nazzy and ARKK names seem to get sold on every bounce. Semiconductors are down about 30% and are officially in bear market territory.

You can also say the same for software names (IGV). Many of these names traded at an exorbitant, non-sustainable price to sales and are now getting punished. Many are down over 50% since the highs.

This is what rotations are all about. You don’t have to see a 20% pullback in the indexes to see extreme problems.

Often times there is battle damage under the hood in specific sectors while the indexes hang in there on a relative basis.

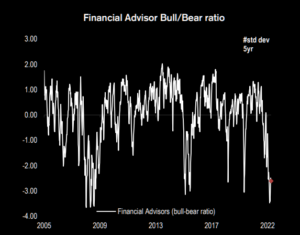

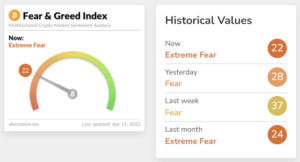

The AAII bull-bear sentiment spread is at multiyear lows. Let’s see if the market will do what it tends to do when this reading is at very low levels (go up). Is another leg higher the pain trade from here?

Crypto is trending lower again. This is a risk-on, not a risk-off asset, contrary to what people thought initially.

So much for Dorsey’s NFT…….

Money grubbers at Goldman Sachs……….

Goldman Sachs who is advising Twitter found Elon’s offer of $54.20 to be too low Meanwhile, Goldman has a SELL rating on TWTR with a $30 price target.

No wonder most of them go to work at The Fed.

Gold and silver are acting better since their wedge breakouts in February. Hoping for a good second half out of these two and related names.

GLD

SLV

Setups

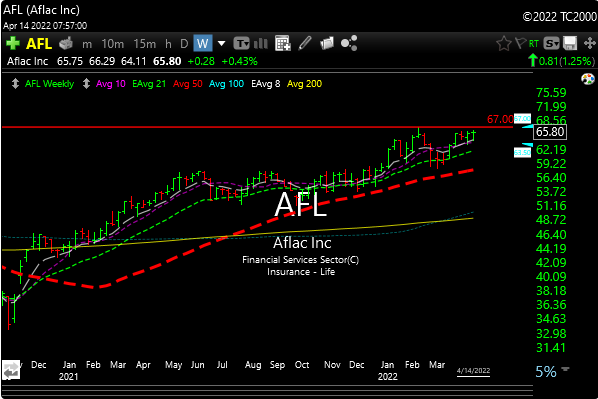

AFL– is setting up bullishly. Coil/flagging at resistance. Breakout at at 67

HCC– another great looking coal stock that s flagging. Broke out of bullish wedge setup on Thursday. Target 43-46

RIO– watch for a breakout over 82.50-83.00 level.

NEX- watch for a breakout through 11.28

VIVO– breakout through 28.50

MUR– Through 43 level

See you in the morning.

P&L here