Dow: +87.06…

Nasdaq: +8.48… S&P: +19.06…

The S&P 500 increased 0.4% on Thursday, overcoming a 0.7% intraday decline on no specific news catalysts. The Nasdaq (+0.1%) and Dow (+0.3%) also recouped intraday losses while the Russell 2000 (-0.4%) still closed lower despite a recovery effort.

Two early headwinds for the market included technical resistance at the S&P 500’s 200-day moving average (4492) and upwards pressure in long-term interest rates. The 10-yr yield settled higher by five basis points to 2.66% after trading at 2.56% overnight.

Nazzy (QQQ) was heading lower but found support at its 50-day moving average and that’s where the reversal happened.

Equities, in general, turned around in the afternoon without a news catalyst, perhaps amid a contrarian mindset as sentiment had gotten too bearish.

Just some thoughts.

Energy (XLE) has been consolidating/coiling. I think it’s gaining energy for another move up.

Coal names also coiling bullishly. BTU, CEIX still look good.

Also, oil may have seen its pullback. Same names will play, OXY, APA etc.

Nazzy and ARKK names got oversold and bounced but not sure how much we can trust tech for more than a bounce.

Commodities are still the way to go. Uranium going nuts as CCJ and URA had great a great day today. Fertilizers too.

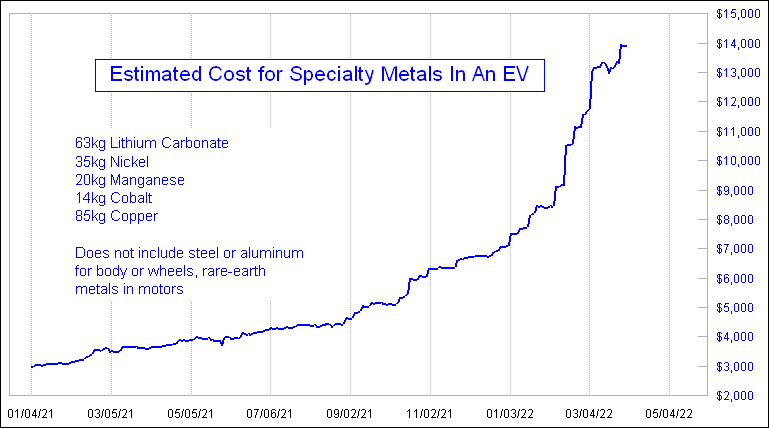

EV’s ain’t so cheap now.