A little greedier than last week but no extreme greed yet.

Friday

Dow: +297.03…

Nasdaq: +70.88… S&P: +31.63…

YTD

- Russell 2000 +13.6% YTD

- Dow Jones Industrial Average +10.4% YTD

- S&P 500 +9.9% YTD

- Nasdaq Composite +7.9% YTD

Big Earnings Weak Ahead

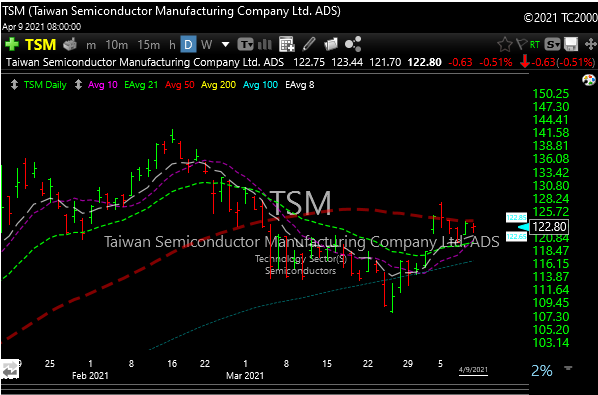

It should be an active week as earnings season really starts to kick-off led by the big financials. Also, watch Taiwan Semi (TSM) earnings before the open on Thursday. Usually a really good tell on what the global chip market is up to. I think the numbers will be excellent. Setting up after the recent dip and right at its 50-day moving g average. Could be a long side trade into the #.

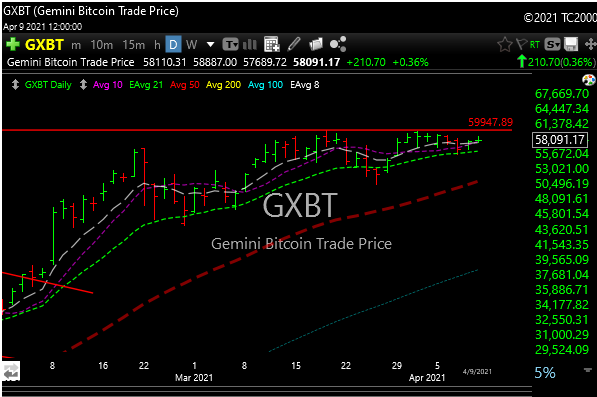

Bitcoin/Crypto

Bitcoin (GBTC) is down about 1% as I write on Sunday. There is talk of reduced supply. It’s at a big spot here. The chart is still very bullish and a move through $60000 this week could start another big leg up, so watch MARA, RIOT, and EHTH.

Also, CoinBase is going public this week. That one may be worth a look after it gets priced. Could run.

MARA is bull flagging (yellow box). Also, that red trend line implies an intermediate price of ’70s-’80s. Of course, it all depends on Bitcoin staying hot.

Gold & Silver

The metals have been garbage, they take time to develop, they always have. When they get hot though they can stay hot for a while. Gold and silver still have work to do but are starting to look a little better, so they are worth watching again, which I am. We are out of AGQ (will re-add at some point) and we are long the gold miners via GDX. In the silver space, PAAS, AG, and EKX look good on an individual stock basis, but I will probably play silver via AGQ and SIL when I get long again.

Where’s the volume?

We have seen an epic implosion of volumes last week.

Monday 4th lightest session of the year at 10.1bn

Tuesday 3rd lightest at 9.7bn

Wednesday 2nd lightest at 9.5bn

Thursday lightest at 9.3bn

QQQ melt up continues with imploding volumes. Not necessarily a ton of buyers, just no sellers.

Blow off Top?

We ran hot into the close Friday. SPX has hit all my short-term targets too. Maybe time for a pullback, or at the very leats a consolidation.

On Friday, SPX tagged the 161.8% Fibonacci retracement (red dotted line) from the COVID lows. Really amazing. Definitely long in the tooth here so be a little more careful especially as we enter earnings season hot and heavy in the weeks ahead.

We could blow out and run to the 4275-4300 level, but this could also be a spot for a pullback. NDX still rallying back hard and cold see a target of 15,000.

Biotech

Two weeks ago XBI started a nice rally off the 200-day moving average. That was a key support area. Now it has turned tail lower and we are back to that 200-day ma. This is a huge spot to watch for the week ahead. Biotech needs to hold these levels or it could break hard and fast to the downside.

Here are some setups for this week.

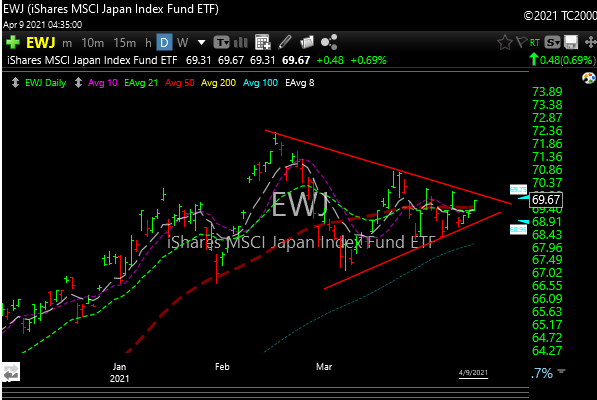

EWJ– I like the setup for the Japan ETF. If it can break back above that short-term red downtrend line we can see targets of 72-75 and maybe higher.

CRTO– Really really get cranking above that resistance line. 42-45 targets.

FBRX- Looks like a massive cup/handle formation to me. As you can see it broke above the downtrend line resistance last week and the volume is big. Also a big short position. It’s a biotech, so more risk but a great setup. Could target 45-48 or higher if the momentum continues.

FUBO– Could have bottomed. It held support last week but then bounced violently on 5X normal volume on Friday. Could be a head fake, but when they reverse on volume like that it can often times signal a bottom.

GBOX-Mentioned last weekend. It broke out and has pulled back to the 8-day moving average. Ideally I would like to see a little more of a pullback to the 15 area, but I will be watching.

OCGN– This is a biotech, and bio is currently under pressure, but notice the big breakout. More importantly, it has gone back down to retest that breakout (also filled the gap) on very light volume. Usually a bullish sign. Its also forming a bullish falling wedge. Could get moving big time once it’s over the 8.05-9.00 level.

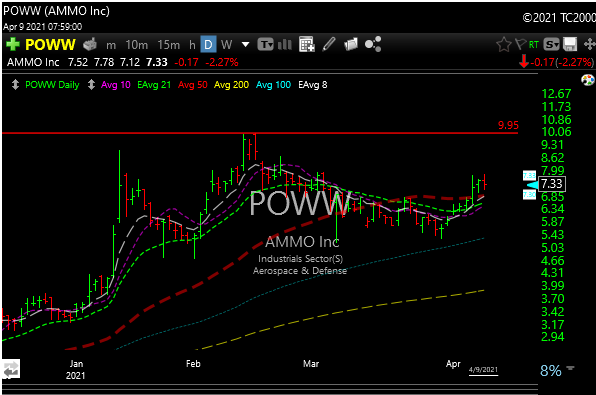

POWW– Great setup and saw better than average volume last week as it broke out of bull wedge. Could continue to the 9.75-10.00 zone.

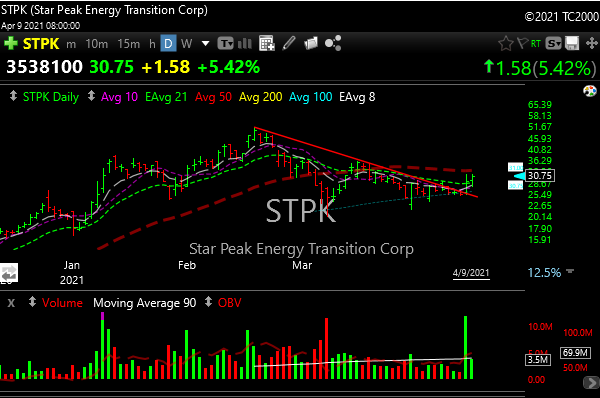

STPK– Another downtrend line breakout last Thursday with a follow through higher on Friday on 4X normal volume. Could target 36 then 41

Heads up on VERU. This one toyed with the stop and traded below it by a little on a few occasions. I stopped it but forgot to remove it from P&L, however, if you are still long, you are ok unless it breaks Friday’s low which also happens to be the 100-day moving average which could act as support. I like this one, but bio has been weak so it’s been dragged down with the group.

See you in the morning.