Dow: +57.31…

Nasdaq: +140.47… S&P: +17.22…

SPX broke out of that little flag that I talked about last night.

The S&P increased 0.4% today, setting intraday and closing record highs in the process amid continued appreciation in the mega-caps and growth stocks. The Nasdaq (+1.0%) and Russell 2000 (+0.9%) outperformed the SPX, while the Dow (+0.2%) underperformed.

It was a real good day for the FAANMG mega-caps today.

Treasury yields have eased a bit and that has helped stock prices. As you can see in the chart below, yield is sitting right on the 21-day moving average. Should that break lower it could provide further fuel for stocks.

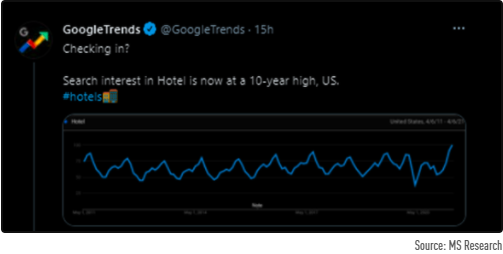

GOOGL says search interest in the term ‘Hotel’ is now at a 10-year high in the US — that’s good for GOOGL (~15% Travel exposure) along with BKNG, EXPE & TRIP, and supports MS’ upgrades this week in the Airline + Casino space.

AAII bullish reading just hit another recent high, surpassing the vaccine news reading this autumn. The fear of missing out on the “next” melt-up is pretty huge. This is the biggest bullish sentiment since just before the 2018 crash. That was fun.

We’ll continue to play it one day at a time, but I don’t think the bulls are going anywhere for a while.

New additions HIMX and KOPN are hanging nicely.

I also added TIGR today. Nice technicals. We just need a little volume and this one can really get running. The first target would be 22.50 which is the 50-day moving avenge.