3209 next big level.

Dow: -157.51…

Nasdaq: -274.00… S&P: -40.15…

- Nasdaq Composite +21.6% YTD

- S&P 500 +1.2% YTD

- Dow Jones Industrial Average -7.1% YTD

- Russell 2000 -7.8% YTD

Apple (AAPL, -6.46, -5.6%), Amazon (AMZN, -174.86, -5.5%), and Facebook (FB, -17.72, -6.3%) declined at least 5.5% in sell-the-news reactions to their better-than-expected earnings reports. Alphabet (GOOG, +53.77, +3.4%) was a notable exception to the negative reaction trend.

The consumer discretionary (-3.0%) and information technology (-2.4%) sectors were lousy all day, largely due to the losses in Apple and Amazon. Notably, the financials (+0.3%) and energy (+0.2%) sectors eked out gains as investors bought the dip into the close.

The dollar slipped slightly so gold/silver were up slightly.

The Nazzy has been most affected here as tech seems to be the sector to sell. That’s where most of the profits are so that’s natural.

We talked about hedge funds being fully invested, however, we pointed out a week ago that they were slowly reducing exposure to the FAANMG stocks. It’s all part of the ebb and flow of the market, but when they decide to finally hit the sell button it can be quick and painful.

Reality is, not much has changed in positioning:

Gross leverage for hedge funds is at 191% (89% tile since 2010) Net leverage at 55% (88%tile).

And we probably won’t get a “real” bottom until we get a little (or a lot) of de-risking from the hedge fund community.

It’s hard for these guys not to want to buy AMZN down $500 in a week. We could see a decent reversal higher this week for the market.

Many stocks that we had profits on turned tail, made round trips lower.

AAPL for example went from 109, our entry, to 125 and closed Friday at 108.50.

The IBUY etf which holds many of the online names like AMZN, BABA, EYSY, etc) turned into ISELL last week.

Percentages below 52-week high for the big guys.

GOOGL -5%, FB-13%, MSFT -13%, NFLX -14%, AAPL -18%, TSLA -22%

Next week is big. We have the US elections, the Fed and the Bank of England, restrictions kicking in…how will they affect macro data, final Oct PMIs throughout the week?, and 224 companies between S&P and Stoxx 600 will report earnings.

Working from home during the pandemic has saved Americans 60 million hours in commuting time each workday. They spent most of that time —working.

So is commercial real estate (IYR) a generational short? Office building card swipes are down 80% in NYC.

Come February, we will have enjoyed an eleven-year bull run from the bottom of the global financial crisis.

Over the past 13 years, central banks have cut rates 972 times and bought $19 trillion of financial assets..and they are still easing.

They will be out of bullets at some point. Rates are negative in a lot of places already, so how low can they go and how much more can they buy?

When the house of cards collapses it should be quite epic and eclipse anything we saw in 87, 2000, 2008-2009, or last February.

However, don’t jump the gun on them running out of cash yet. The ECB plans to increase QE in December and central bank total liquidity is still at about $35 trillion.

So the central scammers still have a lot of dry powder to play with.

When I look at relative strength and stochastics (technical garbage), it’s in the ’50s for SPX and Nazzy right now. Real oversold gets you down in the ’20s, but it doesn’t “have to” get that low for us to reverse higher. I’m just spitballing.

The Fed and global economists are always trying to target 2% inflation. They fail at every turn, even with rates below zero in some places, but there is inflation in spots.

Did you know that potato prices are +92% and onions are +44% in the last year? Spuds ain’t cheap.

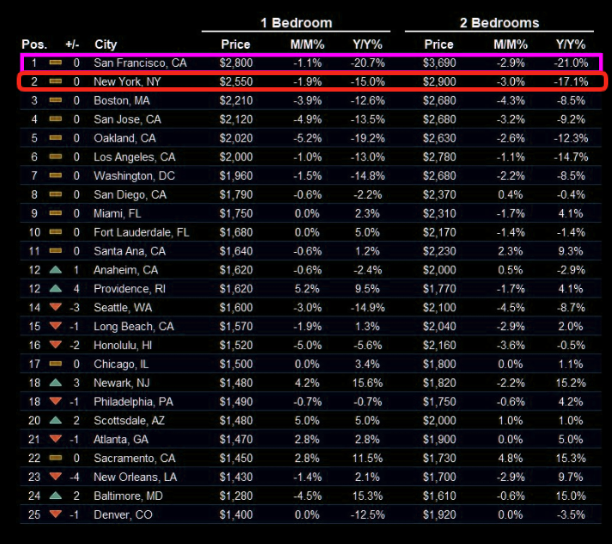

Hello suburbia. SF & NY rents in full crash mode.

Gold and silver have tempted me about a half dozen times over the past month but I haven’t taken the bait yet, although the time may be coming soon and I will overweight when I do it.

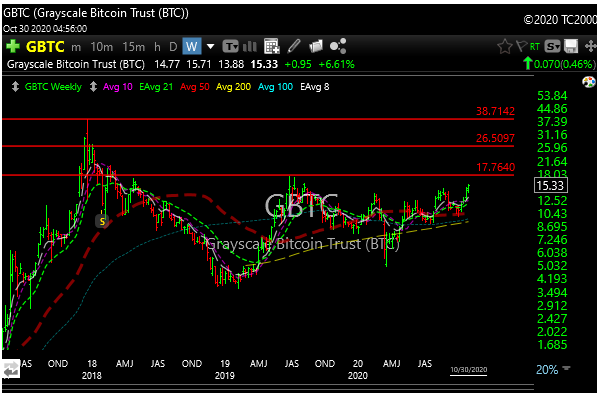

Bitcoin which I’ve talked about, but haven’t added, continues to look excellent. I’m still wondering if this isn’t ready to make a parabolic type move. Last week Microstrategy (MSTR) had $500 million sitting around. They could have bought stock or paid a special dividend, but they put half of it in Bitcoin. The week before PayPal announced they would start accepting Bitcoin and crypto. I’ve said this stuff could be ready to go mainstream. I’m not an expert, but I’m just saying.

Below is a daily and weekly chart of Bitcoin.

Daily

Weekly

Bitcoin has only traded since 2015, but over $ 39 it can be a slingshot higher.

Stocks like INTC and CSCO (owned them both) are morphing into IBM and GE. They’ve become serial “disappointers” and look like they may have both peaked permanently in 2019 and 2020. Shame on me for thinking they might have bottomed.

With all the selling it’s very interesting to note that VIX was only up a percent Friday and treasuries were actually sold, not bought.

So where is the fear? Volatility (VIX) is elevated, but not crazy.

You could have been long VIX almost 30% cheaper last week. Buy it when you can, not when you have to. So we’ll see if they chase protection higher next week or just give up on it. If we rally we will know the answer.

It promises to be a very active week.

See you in the morning.