- Nasdaq Composite +29.1% YTD

- S&P 500 +7.6% YTD

- Dow Jones Industrial Average +0.2% YTD

- Russell 2000 -1.9% YTD

The S&P rose 0.9% on Friday and ended the week with a 3.8% gain, as investors remained encouraged by reported progress in stimulus talks (I don’t trust them), and positive corporate commentary. The Nasdaq outperformed with a 1.4% gain, followed by 0.6% gains in the Dow (+0.6%) and Russell 2000 (+0.6%).

The White House was reportedly drafting a $1.8 trillion stimulus bill, up from a prior $1.6 trillion and up from $1.2 trillion before that, representing an about-face from the previous stance aimed at standalone relief bills. The word over the weekend is that Pelosi rejected it.

President Trump advocated in a radio interview for a bigger stimulus package than what both sides are offering. Truthfully, the reaction in the market on Friday wasn’t that impressive considering the news contributed to only a small bump in the S&P 500, which was already trading higher before the headlines.

The market has been happy again as it front runs more potential stimulus and a potential vaccine. A lot can go wrong though.

AMD saw some weakness on Friday as they announced that they want to buy XLNX for about $30B. Usually, the stock price of the acquirer will see initial weakness and that’s what we saw on Friday. Meanwhile, on the chip front, SMH made more all-time highs.

SMH tagged the 161.8% Fibonacci retracement from the Feb lows on Friday and has now seen a double since the March lows.

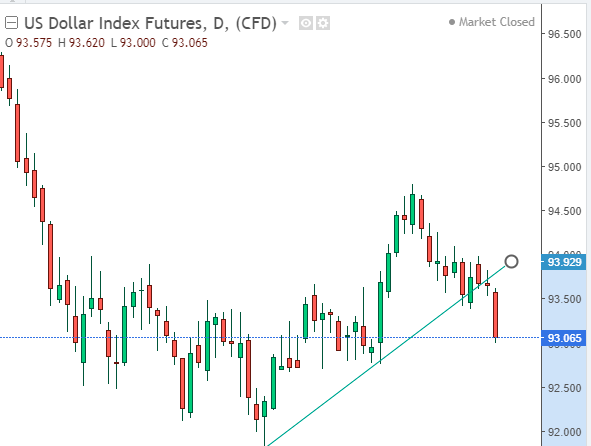

The market was juiced on hopes of a bazooka like stimulus coming soon. The action in the dollar told the story.

That dead cat bounce in the dollar that we saw over the last month may now be over. Notice that the greenback lost short-term uptrend support last week. The metals loved the weak dollar last week and “may” have put in a bottom and could start a new wave up.

The dollar has been moving around more on politics than anything else though lately, so I’d rather wait.

The greenback remains very shorted and the shorts had a bad time of it the week of the 21st, but they are feeling better now, especially if we get more printing/stimulus. The overall trend is still bearish from the top in March.

If you look at the gold etf (GLD), you can see that it broke above downtrend resistance on Friday. The 50-day moving average is just above.

I’ve been waiting for the dollar to crack a little before revisiting gold/silver so I am watching with a lot more interest again.

Silver had a good day Friday, but the chart doesn’t look as bullish as gold yet. That can change, it needs to string together some more positive days.

The gold and silver miners woke up last week. See GDX, GDXJ, SIL, and SILJ.

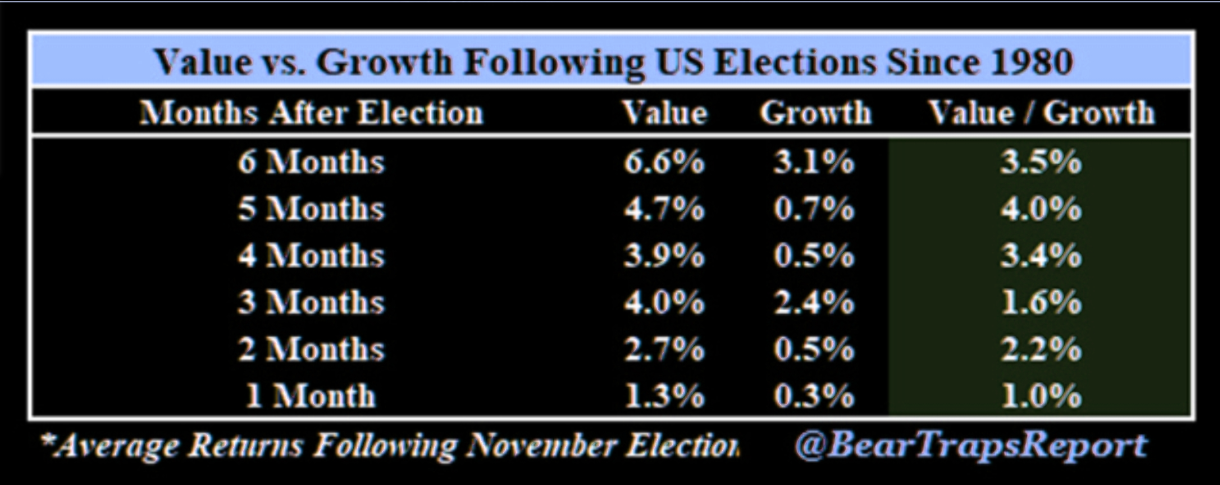

So what moves after elections?

Value stocks outperformed growth for 6 months after every Presidential election since 1980.

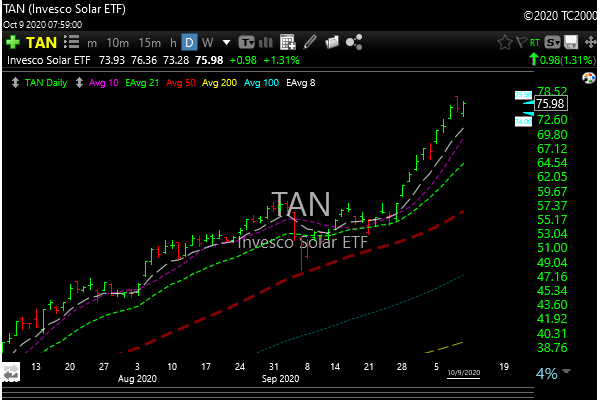

What looks bubbly?

How about solar? Solar has run higher as Biden’s stock rose. He better win for the solar longs. The “obvious” trades usually end in tears, because the opposite result often occurs. But I’m a contrarian by nature.

Hard to pick tops, but I would run from this etf from the long side.

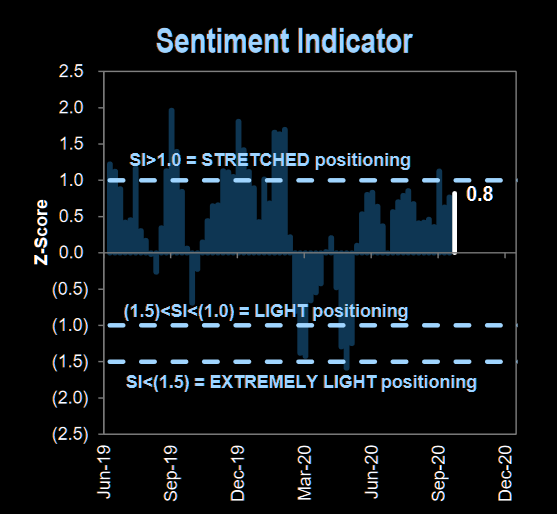

Greed ticked up a little last week, but far from extreme readings that we have seen in the past.

GS Sentiment Indicator measures stock positioning across retail, institutional, and foreign investors versus the past 12 months. Readings below -1.0 or above +1.0 indicate extreme positions that are significant in predicting future returns. Sitting at 0.8 right now.

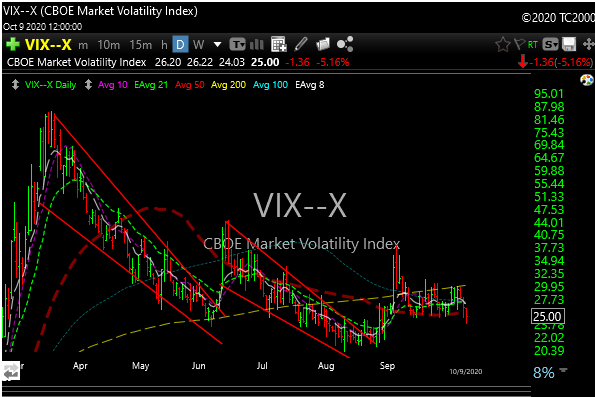

The VIX isn’t showing any fear but is still elevated from those “low-teen” levels. This may be the new “normal” area for VIX. Not scared, but “always a little nervous”. But again, stuff can go wrong fast, and they always say, buy protection when you can, not when you have to.

Fun Fact….

On average, AAPL outperformed the S&P by 13% in the 6 months post a new iPhone launch. On Tuesday (Oct 13), AAPL is set to unveil 4 new devices.

Here are some watchlist names for this week.

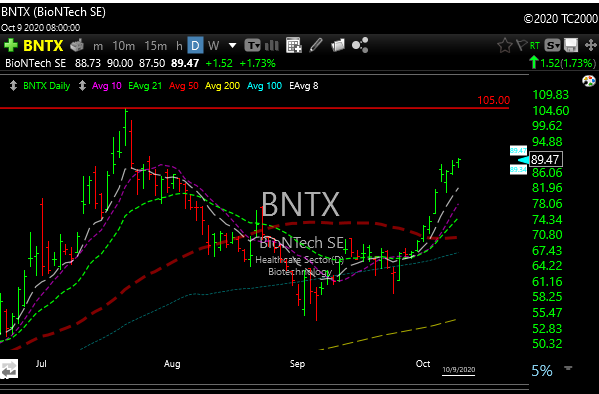

BNTX-I’m always a little cautious about the vaccine drugs, these guys are working with Pfizer. The chart looks great. Technicals are good, with strong volume coming in and it’s flagging. Target 105

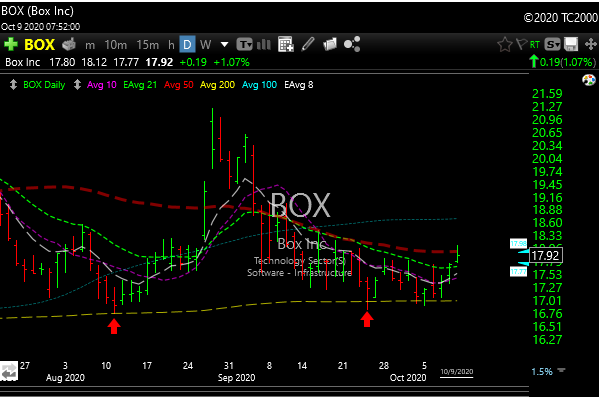

BOX– may be ready to go again after the double bottom.

ZYXI– seems to be coming out of a 3-month base. 21.50-23.00 targets.

PAGS– May need to flag/consolidate for a few days, but looks like it wants the all-time highs at 45.75, then maybe higher.

JETS– COVID crushed the airlines then Zoom (ZM) peed on its grave. When traffic comes back it will probably be so much less than it used to be, but the chart looks good and most of the flying Petrie dishes are very shorted. Could get moving once over the 19 level to the low 20’s.

INS– Big pop on volume recently, now flagging/consolidating. Looking for 45.50-48.00.

It should be a fun week as we wait for the stimulus talks to implode because politics must get in the way.

Hey shorts….think of the day when there is no more stimulus. What a time it will be.

Watching my Jets go 0-5 with cardboard fans and piped in crowd noise……yay!!!