- Nasdaq Composite +22.7% YTD

- S&P 500 +3.7% YTD

- Dow Jones Industrial Average -3.9% YTD

- Russell 2000 -6.0% YTD

The S&P 500 eked out a 0.1% gain on Friday to close out a strong week for equities. The Russell 2000 outperformed with a 1.6% gain, as a better-than-feared July employment report contributed to the outperformance of small-caps and value-oriented stocks.

The Dow increased 0.2%, while the Nasdaq fell 0.9% amid relative weakness in the mega-cap stocks.

It was a strong week for stocks, as the S&P 500 closed higher in every session for a 2.5% weekly gain. The Russell 2000 rose 6.0%, the Dow rose 3.8%, and the Nasdaq Composite rose 2.5%.

The top-weighted information technology sector (VGT) pulled back 1.6% Friday.

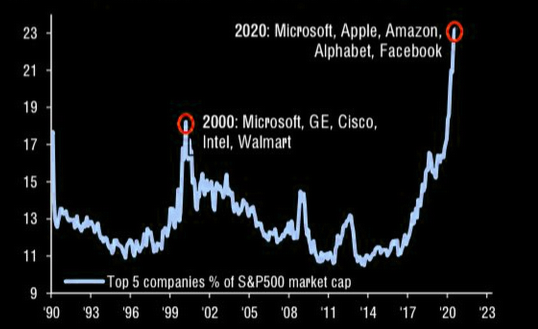

Only MSFT is still in the Big 5 twenty years later.

We talked about a possible rotation out of big tech a couple of weeks ago and into financials and energy. We haven’t really seen it yet, but financials look like they are starting to get bid up as they start looking at some of the lagging sectors. Both XLF and KRE are starting to look a lot better. KRE especially had a decent week.

Gold, silver, and the miners took a little break Friday, but still no damage done. The dollar bounced a little last week so that was a minor headwind.

Soft commodities might be starting something as they have lagged hard commodities. MOS & CF look good.

As our nuclear war with China continues, Tencent had a bad end of the week. Tencent is a big China company that owns a ton of tech-related names like ATVI and many others. Tencent is also the second-largest holding in EEM and FXI. Here are some other names in Tencent’s gaming portfolio.

China internet etf KWEB had a difficult Friday after a double top on the daily chart.

Sea of green. Tech was up 3% last week and was only the fifth best performer.

The greed-o-meter is moving right and into the greed zone again.

Seasonally August is a bullish month for VIX, but no fear yet.

Deutsche bank is out saying that The UK recession in 2020 is likely to be the worst since 1710. That’s before the industrial revolution, and during the final years of the reign of Louis XIV.

I hope the world doesn’t run out of paper to print all this fake money.

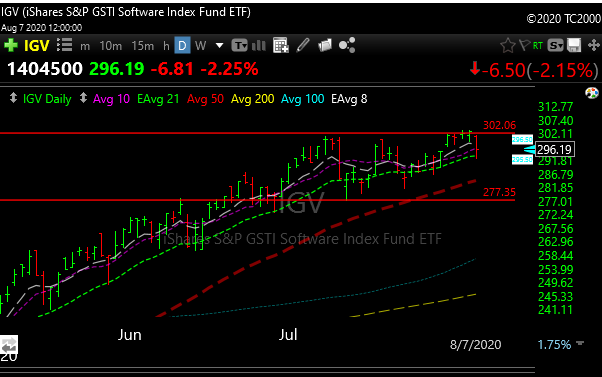

Software (IGV) may look a little tired. Only one day, but it’s in the nosebleed seats. If they decide to take some money out of this space, we could see a move down to the 275-280 levels.

The chips (SMH) still seem untouchable right now. Believe it or not, the 161.8% Fib retracement comes in around 187. It closed Friday around 169. XBI and IBB hit those Fib levels, why not SMH?

Some setups for next week.

AXSM– I like the setup and the technicals aren’t bad at all. It held 200-day moving average support and is just under its 50-day moving average. If it gets through Friday’s high on a closing basis it may be the start of something good.

MOS– soft commodity that I would like to get a buck cheaper, but has momentum. Red lines are initial targets.

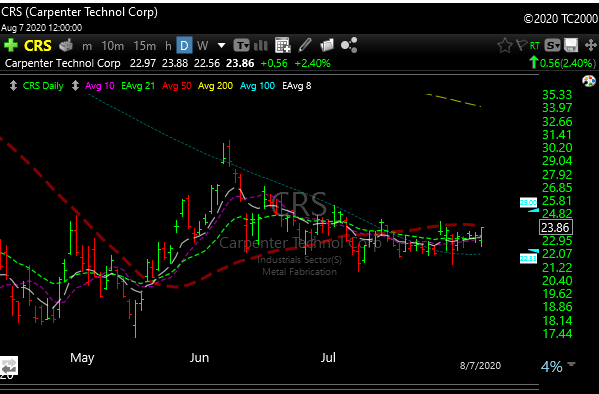

CRS– nice setup with improving technicals in the metal fabrication space. 25.50-27.00 targets

TMST– I’m looking at the steel group again, many have great charts. Here’s a cheapy.

More thoughts as the week progresses. Have a great day.