As the economy melts away and implodes under its own weight, the market keeps crawling higher.

Greed and fear are fascinating topics. I always thought fear was the stronger emotion. Markets go down much faster than they go up, right? Stairs up, elevator down is usually the case.

Notice how we got crushed on the downside on high volume but this recent rally is on lower volume.

Right now, greed (not extreme, but less fear) is back in charge. That could change Monday morning, or we go and make new highs in the next few months. Stranger things have happened.

All the market has right now is the Fed. The Fed is buying everything in massive magnitudes. Not just treasuries either. In past economic debacles, that’s all they bought were treasuries. Now they are buying ETF’s like LQD and HYG (corporate debt etf’s).

I never guarantee anything, but one thing I will almost guarantee is that if we go down and retest the Feb lows, or even worse, break those lows, the Fed will be on the bid for all things Nazzy and S&P.

So the Fed “put” is always there, and yes they do have more dry powder.

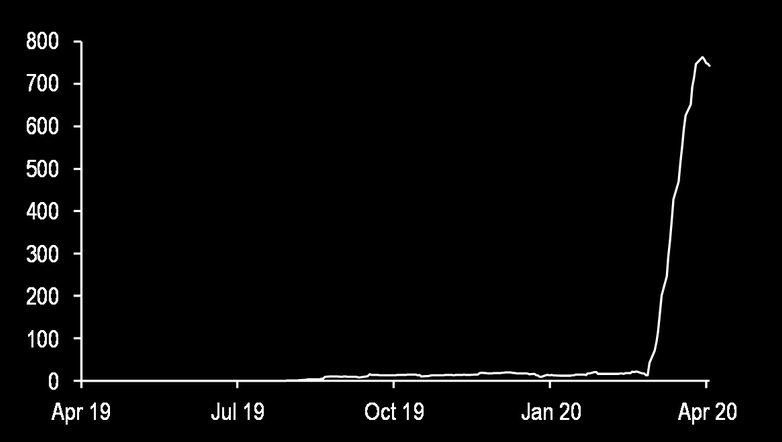

The Fed has bought over $815B in 10-year equivalents in just the last 30 days.

In the last 4 weeks the Fed has printed more than twice as much money as it did in its first 94 years of existence (from 1913 to 2007).

Go Socialism!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

You can argue all day and night whether or not this is even a “real” market anymore.

FOMO (fear of missing out) has played well since we saw the bottom, so the greed element has kicked in. There is no more earnings guidance for the most part so the algorithms are winging it and buying blindly. Momentum is a powerful thing.

TINA, (There Is No Alternative), has also kicked in. You want to buy a treasury that pays you nothing, or do you want to take a shot on a blue-chip that will pay you 3-4% while you wait for the world to become a safer place again? The latter of course.

The GBC (global financial crisis) felt much worse to me than this “little blip” though. This was a “one-off” Black Swan that hopefully can be remedied in fairly short order. The jury is still out. It still doesn’t change the fact that this economy is probably more “wrecked” than 2008-2009 even though the duration of the pain may be shorter. It depends on how fast we become a functioning “back to work” economy again. I guess that is up for debate. As Trump said, this country wasn’t built to sit at home.

You may not know this, but the Nasdaq is now up for the year by about 1.0%. That’s amazing.

Check the V shaped bounce in the Nazzy as it hits resistance.

As we go higher here, the bears argument gets louder, but just because something is “up a lot” is no reason to short. Strong stocks can stay strong and get stronger.

It’s confusing out there now because there are some mixed signals and I will give you two examples.

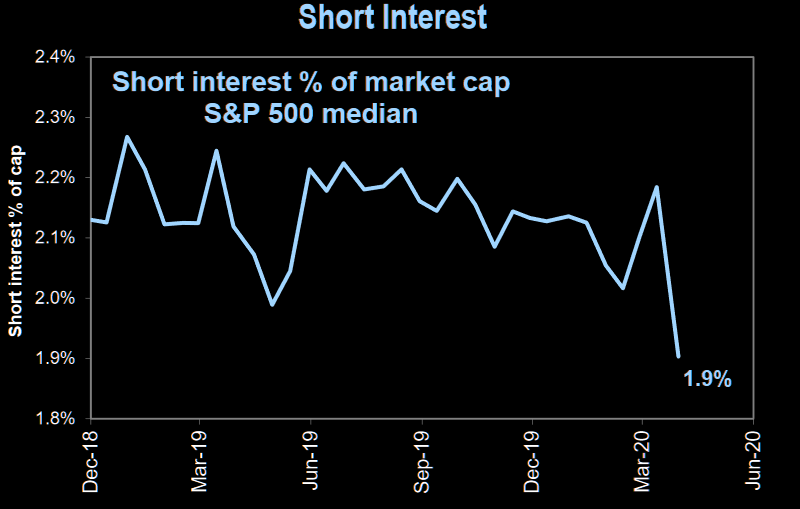

The first one is short interest. Right now, short interest is printing multi-month lows again. This usually means that the phone booth is jammed with optimistic bulls again. This is one of my favorite contrarian indicators.

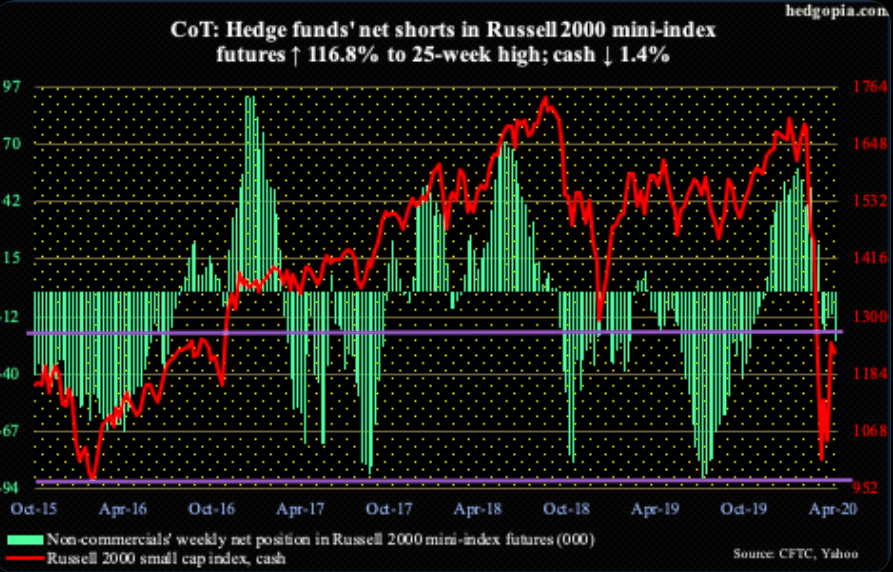

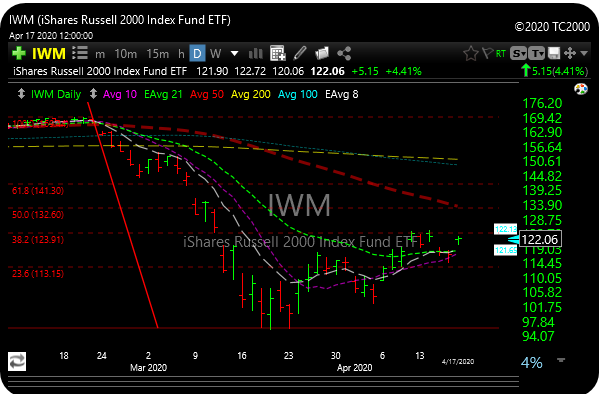

But on the other hand, if you look at the Russell 2000, it’s the complete opposite. Hedge funds net shorts in Russell futures are at 25-week highs, so if you’re a contrarian, you can make the case for a potential melt-up.

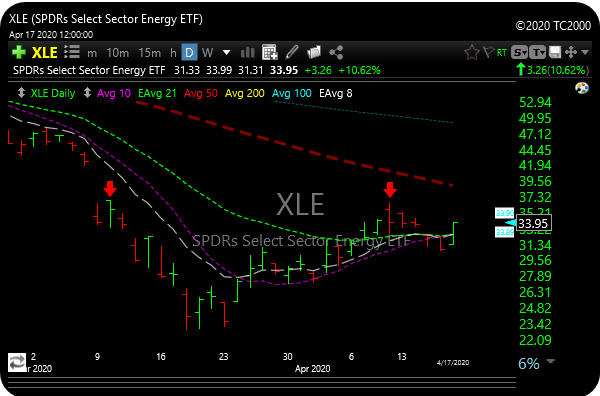

Dont get me started on energy because this space is confusing. As I thought, oil broke $20 and looks brutal, WTI was down 8% Friday and closed around $18.

However, XLE was +10.6%. So obviously there is a disconnect.

XLE

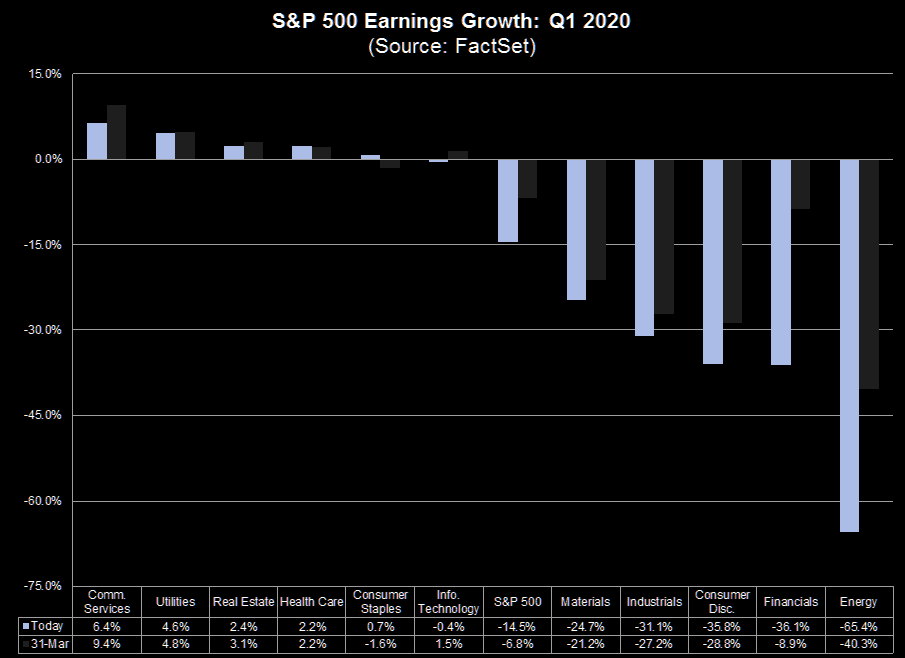

Energy earnings are the worst in history, but is this reality starting to get baked in?

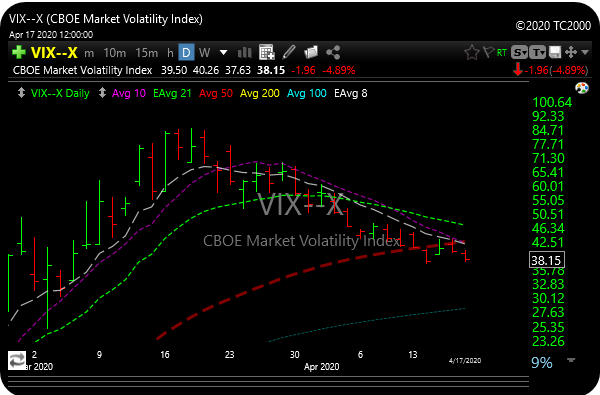

The VIX spent 2 of 5 days last week under $40. That’s a happy datapoint, but is that just a bullish falling wedge (bearish for market)?

In the “thinking out loud” department, here are two etf’s to watch, maybe for shorts (or not, I’m just watching for now).

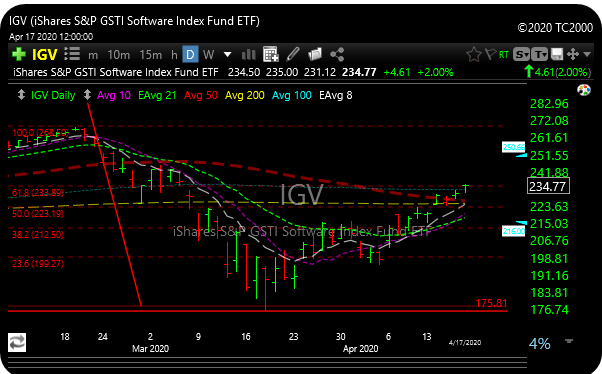

IGV is the software etf. Huge winner the last couple of years but got hammered in the crash.

Right now, after a 35% rally in a month, it is hitting resistance. On Friday it closed a buck over its 61.8% Fibonacci retracement level. Its also at lateral resistance from early March. This is one to consider for a short if the market takes a leg lower.

VGT– Information technology finds itself $1 under its big Fib resistance level. So the same applies here. Keep in mind, these charts are strong for now, but these are ideas if we roll over again.

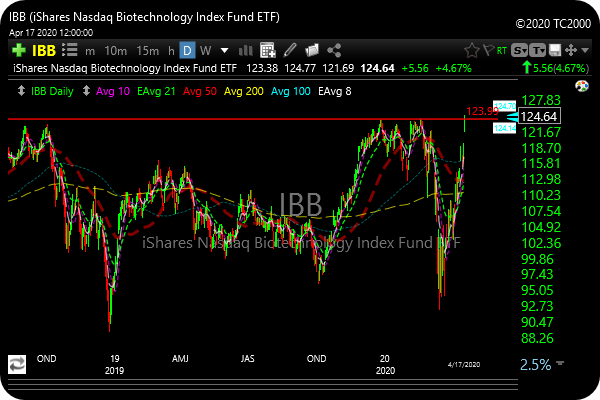

Probably the most fascinating thing to see over the last two months, to me anyway, is the strength in biotech. This is the most risk-on group out there, but look at what IBB has done.

It put in a high for the year on Friday and isn’t that far at all from all-time highs.

For you small business owners out there, want me to make your weekend?

The CARES Act is now depleted for small business loans. Harvard’s endowment is 38 billion dollars. The Harvard Crimson just proudly reported that ” Harvard University will receive nearly $9 million in aid from the federal government through the Coronavirus Aid, Relief, and Economic Security Act, the Department of Education announced last week.”

It’s all good. Whoever said life was fair?

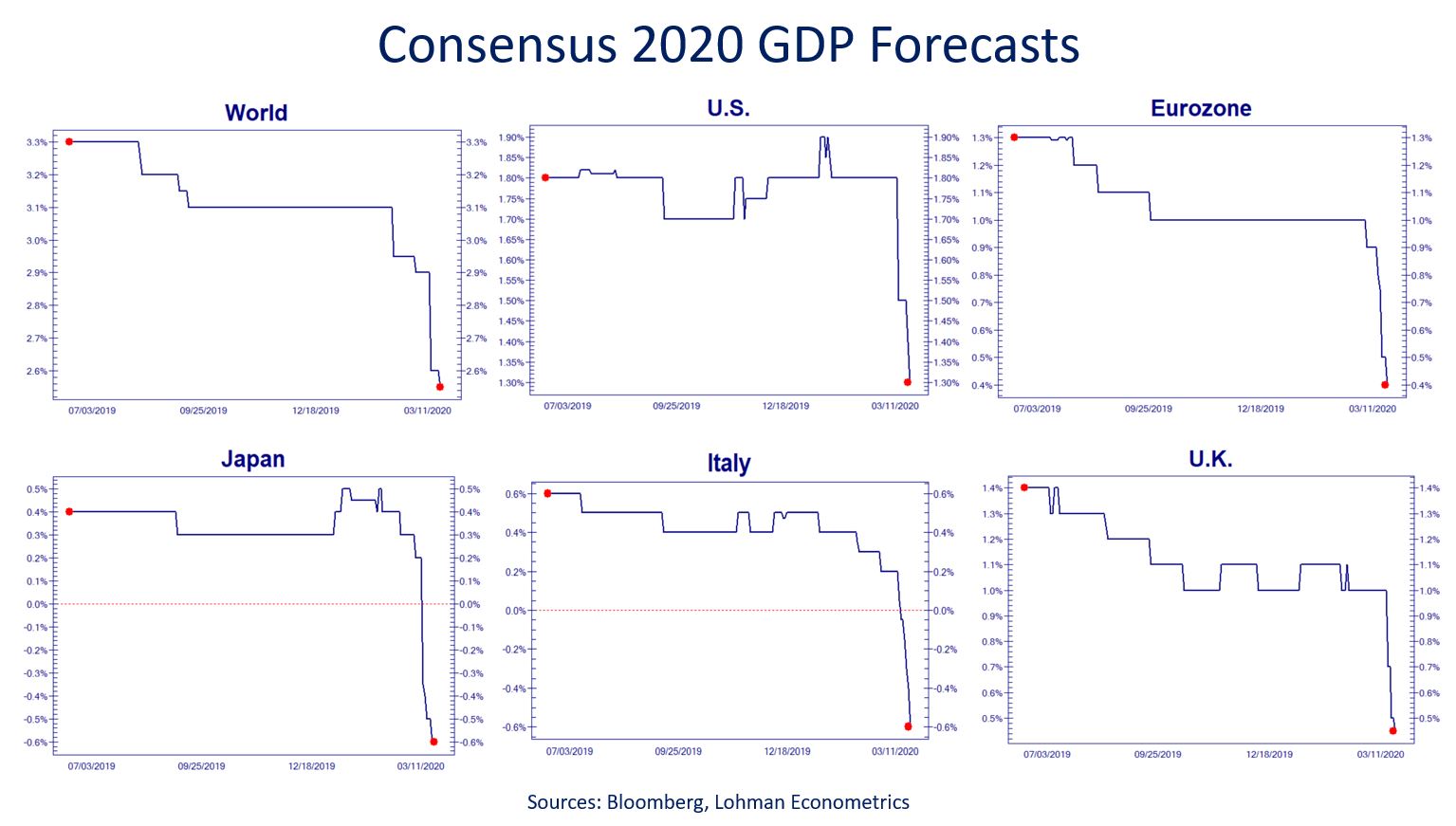

P.S. The global economy has been in recession for 10 months, today the IMF came out and said there was a 100% chance of a recession.

My head is already exploding and the weekend has barely started.