Dow: -445.41…

Nasdaq: -122.56… S&P: -62.70…

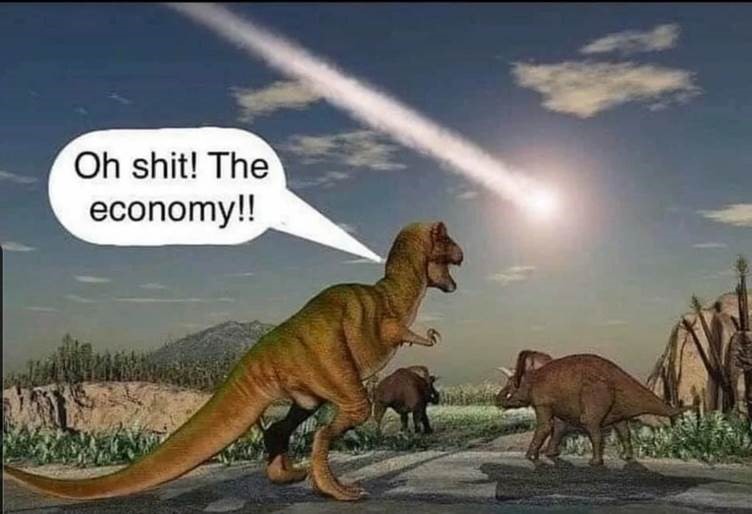

The coronavirus itself has probably been discounted to a huge degree already. The true fallout to the economy will be the discussion now as we move through the rest of the year.

Earnings have been eviscerated, we all know that, so now the conversation moves to the timing of the economic recovery.

There are some very bearish thoughts on this and some very bullish thoughts on this. I’m in the camp that no one knows, so just trade em as you see em.

Analysts have cut estimates for 450 companies, which translates to an all-time low up-to-down revisions ratio for the S&P 500 in the four decades they have been tracking data. The largest cuts are concentrated in materials, industrials, and energy, while expectations have held up best in utilities and consumer staples.

Highlighting the data today: retail sales declined 8.7% m/m in March, industrial production declined 5.4% m/m in March, the Empire State Manufacturing Survey for April plunged 57 points to -78.2, and the NAHB Housing Market Index for April plunged 42 points to 30.

We’re a train wreck, but its not a surprise.

Airlines won’t go bankrupt, but who will fly? Baseball may restart, but who will go? More bodily fluids are exchanged in the NBA and NHL than a Roman orgy, so will that get kicked out until 2021? The golf Majors are rescheduled to start in August and end in November. So the summer is pretty much dead for them.

I would hit a bar tonight if they would let me and I would fly tomorrow if I had somewhere to go, but how will most people change their style of living? Everyone is different. P.S., I have a crazy straw that slips right through my COVID mask, and by the way, if you have a beer in each hand it’s really hard to touch your face.

They took a poll today and 68% of sports fans said they wouldn’t attend a big sporting event unless and until there was a vaccine in place for coronavirus.

The Fed isn’t buying stocks yet, but they did start buying corporate debt etf’s and they are trading like biotechs right now. HYG and MUB have been popping too.

Energy is still a train wreck. The energy sector (-4.7%) declined the most today as the group remained pressured by lower oil prices after the EIA projected a 9.2 mb/d decline in oil demand in 2020. WTI crude futures settled just below $20.00/bbl, losing 1.3%, or $0.27, to $19.95/bbl.

You have to wonder how long the S&P can absorb sub $20 oil. How about negative oil?

Fun fact…….

If the March 23 low holds, it means that the last three bull markets began in March:

March 11, 2003

March 9, 2009

March 23, 2020

See you tomorrow