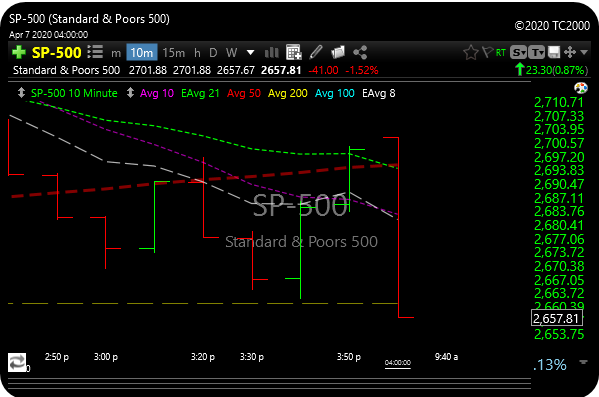

SPX 45 point dump in last 10 minutes

It was actually a pretty ugly reversal today. A big move up followed by a selloff that closed the indexes on the lows of the day going away. It seems stocks started topping out for the day just after lunch.

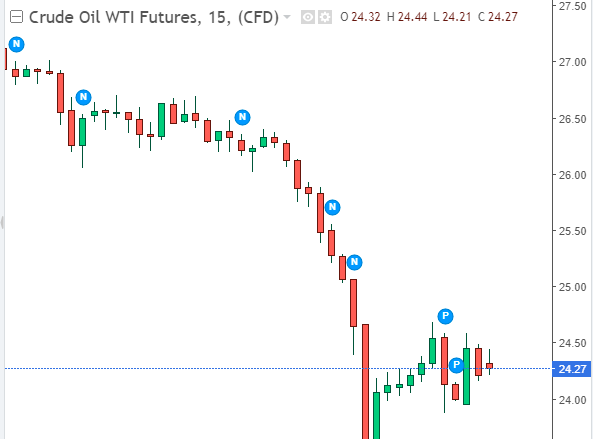

The drop in equities had a lot to do with the sudden drop in crude oil, but it doesn’t really explain the last 10-minute waterfall in the indexes.

What’s next for the market?

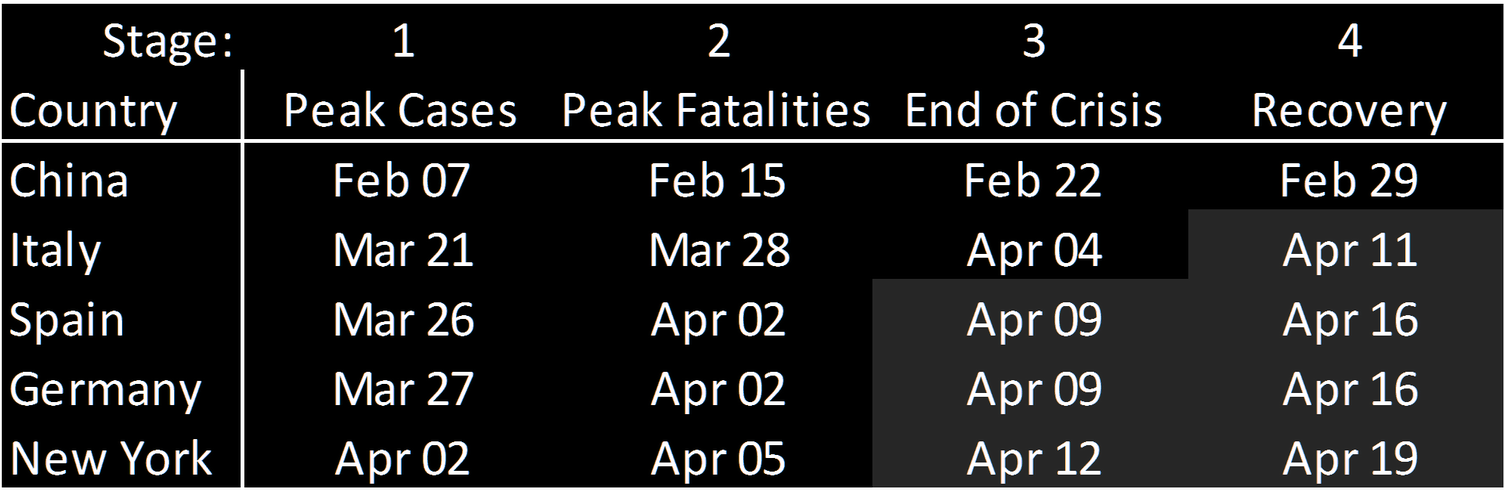

The market got massacred off the cornavirus numbers in Italy then rallied hard on better numbers over there. Barring a big turn for the worse, they may have felt the brunt of the pain already.

So it feels unlikely that market will continue to treat improvement in US data the same way (ie market has now discounted that the light at the end of the corona tunnel actually is the end of the first wave of corona). What shall we focus on now / what can drive this market even higher?

That’s the rub. COVID isn’t done yet, but hopefully, it will be very soon, so where does the focus go then? Is that when we go down and retest the lows because the market convinces itself that things are very bad? Reality check time.

Some of the corona plays like ZM, APT, BNTX, and CODX have been hammered as the optimism about coronavirus is growing. APT, BNTX, and CODX are down over 50% from recent highs. ZM was priced for “end of days”, basically a bubble-wrapped society that will never leave the house again.

The third stage of recovery occurs about a week after the 2nd stage and also lasts about a week. In the third stage of recovery, fatality growth declines dramatically, by over 60%, as most critical cases are resolved. Only China has passed the third stage, and Italy most likely entered it recently. The fourth stage is near complete recovery where both new cases growth and fatality growth are very low, likely below the typical influenza-like illness level during peak season.

So some experts in the area are calling for this week and next to perhaps be the most brutal, then it gets better, we’ll see about that.

So once coronavirus is “out of the way”, then we pick through the rubble….and there’s a lot of rubble.

The market will do its own thing regardless.

Wanna get pissed? Hedge funds & private equity firms are applying for the PPP (small biz loans/grants). I guess their fat management fees just aren’t enough. This is a gross abuse of a program put in place to help small biz. It’s like Park Ave hitting up soup kitchens.

I ran a hedge fund during 9-11 and I was in the WTC. They were throwing money around and I didn’t take a freakin’ penny. I could have. We were solvent, we were sidetracked, we worked three times as hard. These pigs should be shot in the town square.

In other news, oil and energy have decoupled. Oil was down 9.0% today, but XLE was +2%.

We will see where this “big” meeting with OPEC goes. There was talk of a 10 to 15 million barrel a day cut. Now Im hearing more like 3.

Also, a lot depends on what Canada and Mexico do, and if this is to work, OPEC wants US drillers to cut production too. Not sure how that will play.

Too many moving parts, I’m bearish on crude again after the recent pop. Decent trade if you played it.

I’ll leave you with this one for tonight….

Direxion, the leveraged etf company, the guys that bring you FAZ and FAS, just filed for a Work From Home ETF (WFH). The ETF will hold companies that do “remote communications, cybersecurity, project and document management, and cloud technologies.”

Sign of the times.

My own ETF will be starting soon. It involves companies that produce duct tape, bubble wrap, Kevlar vests, grenades, aluminum foil, Jack Daniels, and propeller hats. The ticker will be FEAR.