Dow: -2013.70…

Nasdaq: -624.94… S&P: -225.81.. 10-year Treasury 0.49%

“It’s unbelievable how much you don’t know about the game you’ve been playing all your life.” — Mickey Mantle

The S&P dropped 7.6%, oil prices tanked 25%, and Treasury yields continued to fall to unprecedented levels today after Saudi Arabia crashed the oil market and coronavirus cases accelerated.

The Dow (-7.8%) and Nasdaq (-7.3%) performed comparably to SPX, while the Russell 2000 (-9.4%) underperformed.

Other than that, today was just frickin’ awesome.

There are a thousand storylines to talk about but it’s fruitless to discuss at this point. At this juncture, its all about getting so oversold that we reverse higher in a big way, and we will, this I will guarantee.

They say you’re in a bear market when your down 20%. The Russell is down 24% right now, so just shoot it. There are a lot of small and regional banks in the Russell, that explains a lot of it.

So where’s the bottom? I shot out a chart of the SPX to you this afternoon showing that June 3 support was fast approaching. It came within 6 points of that level. SPX closed just 3 points off the lows of the day. A bad day. Not sure if that June low will hold tomorrow, maybe it will, maybe it won’t.

Here it is again.

I almost nibbled a few things long near the close, one was APPL. It dropped $6 from where it would have bought it just before the close. In like 8 minutes. Tough to pick bottoms. That’s just an example of how levels you may like to enter still get violated…..and fast.

I wanted to buy mid-afternoon too, but then I thought whatever asset prices decide to do for the balance of the day will only be obvious in retrospect. When I feel that way I just sit on my hands.

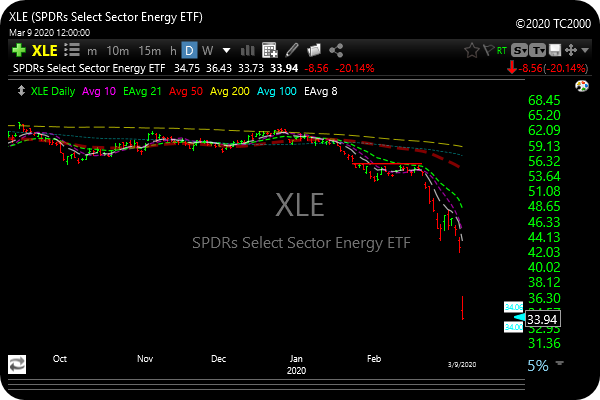

My only positive takeaway going into tomorrow is that oil probably won’t fall another 25% and XLE probably won’t fall another 20%. So we probably have that going for us.

To give you an idea of the damage done in the oil patch today, OXY was down 54.4% and HAL was down 37%. I never thought I would see HAL trade at $8, or OXY at $12 for that matter. There are body bags all over the place today in oil. Low to mid $20’s oil could be a real possibility in the months ahead.

As a follow-up, that OIV (Oil Volatility Index) that I showed you this morning ended up 95% today.

I can’t be too critical of physical gold or GLD, the etf, because it’s still hanging around six-year highs, and it has had a good move already, but the miners are really pissing me off.

GDX and GDXJ just acted pathetically today. No excuses.

Rates are near zero and the greenback is imploding yet they are selling off. Both (rates and dollar) should be perfect ingredients for a massive rip higher but we’re not seeing it, at least yet.

GDX and GDXJ both tanked on the Feb 28 lows, but then they saw a massive four-day rally. The action in the miners on the 28th was unexplainable too, so I will watch and see what I will do tomorrow and let you know soon as I know.

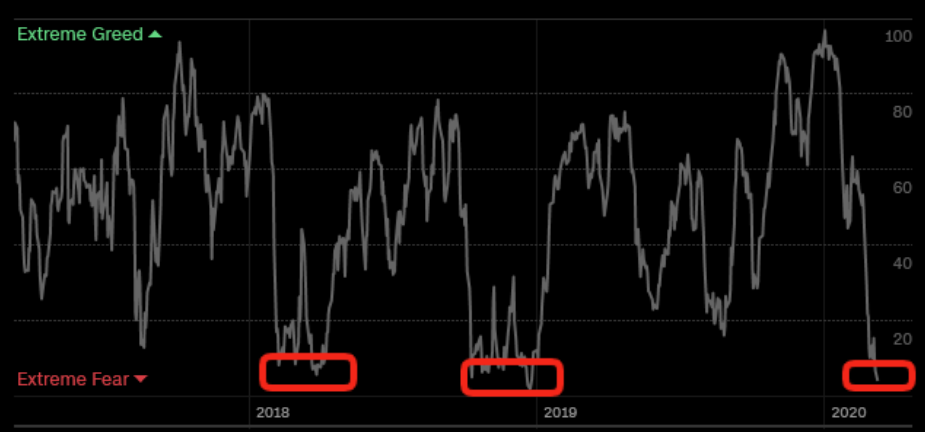

Right now fear is extreme and that Fear-O-Meter closed with a reading of 3 today, the lowest ever I think.

In the “Fed is impotent” department, you can see that as their balance sheet grows by the nanosecond, stocks still fall.

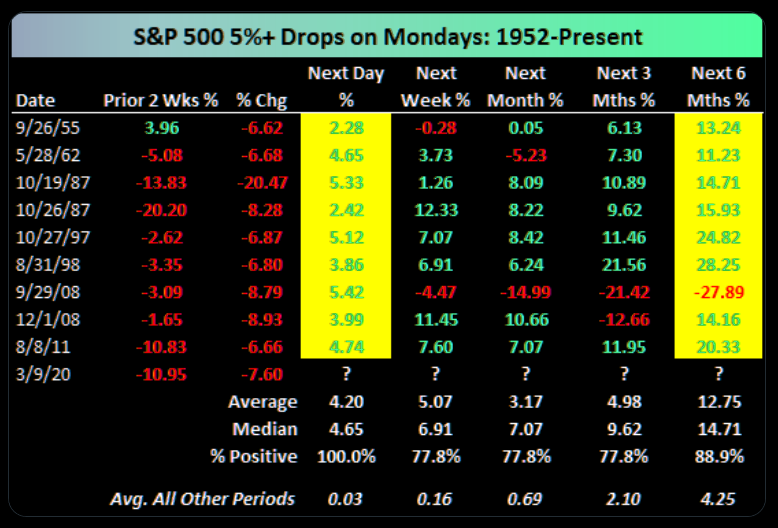

Days after -5% or more moves on Monday’s.

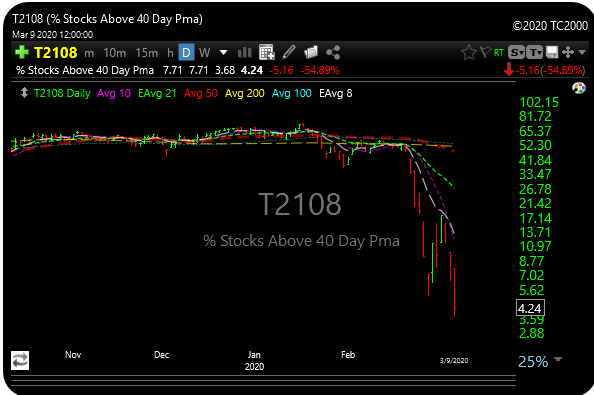

The two charts below show you how absolutely oversold we are.

Only 11% of stocks are over their 200-day moving average.

Only 4% of stocks are above their 50-day moving average.

I hope I don’t regret not getting really long near the close today, but when they close them near the lows I will usually take a pass.

See you in the morning.