| Dow: +1167.14… Nasdaq: +393.58… S&P: +135.67… 10-year Treasury 0.74% |

The Fear-O-Meter is up from a 3 reading yesterday. Imagine if we got some greed?

You have to go back to your 2008 market crash notes to figure out all the fun things the government can do to bail out this train wreck of a market.

We rallied hard today on a couple of things. The White House is floating a payroll tax break that would stretch out to November. So no payroll tax until November? They are also talking tax cuts and various other forms of fiscal stimulus that I don’t think they even have a handle on yet.

I’ll believe it when I see it.

The market loved it though, even though none of it is close to done yet. If it turns out to be a lot of BS you know what this market will do.

I bought some things today. It’s so hard to block out the white noise and focus, but what made my decision was the chart that I have shown you twice in the last two days.

When you see a 225 point Dow move on a 10-minute bar and a 25 handle SPX move on a 10-minute bar you know things are crazy.

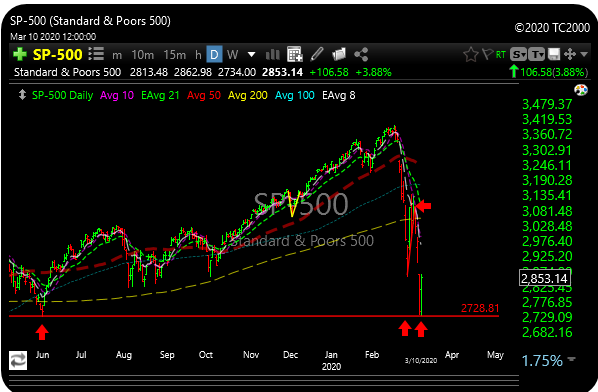

That June support level held on SPX. It held yesterday, and it held twice today when the SPX went down to retest it. All three of those lows (including the June low) were only a couple of points apart, which is truly amazing in itself, so if that isn’t bottom support I don’t know what is.

Here it is again. It shows the three support levels.

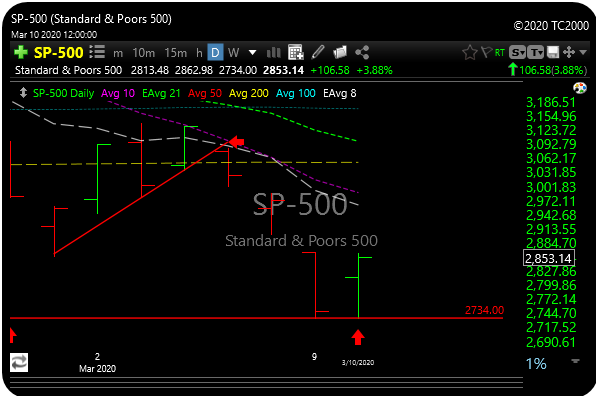

Here’s a close up look at yesterday and today’s lows. As I said, pennies apart between yesterday and today.

After the second test at around 11:45 the market bounced and really never looked back.

Could I have bought earlier? Yes, but it’s hard to trust anything. It also took me until 3:30 to remove all the glass from my eye from the horrific miner trade.

When it looked like the strength would stick I then felt they were going to run it and maybe close it near the highs due to a short squeeze and a little FOMO (fear of missing out). They did, let’s see if it sticks though. I’m not a bottom caller, but today “may” have been the short term bottom we were looking for. Expect volatility. It probably ain’t over.

If it does stick, then there is some decent room to the upside over the short term.

If those lows I showed you don’t hold, then watch out below. Still, nothing is safe because headlines are insane and have a lot of impact. Algos trade off of headlines and it can cut both ways as you know.

I didn’t go full throttle today but added SSO and QLD so we have exposure to SPX and the Nazzy. I also added AAPL because all the institutions come running for that one, even with problems in China.

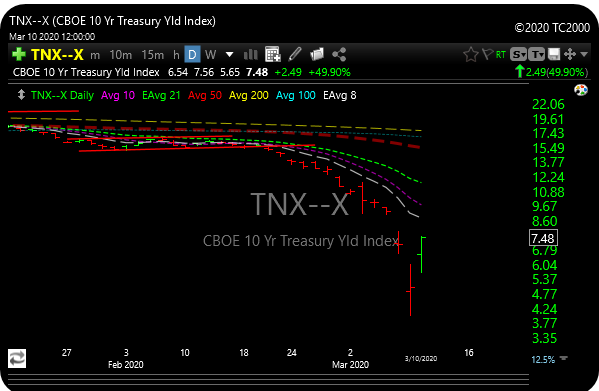

It helped that treasuries got sold today. The 10-year treasury was actually up 50% from yesterday to yield a whopping 0.74%. This is way off yesterday’s low yield of 0.39%.

Oil caught a little bounce post evisceration today. But there are problems in the oil patch and there will be more. OXY stopped trading and cut its dividend by 86% today. More will follow. The White House is looking to bailout shale companies now.

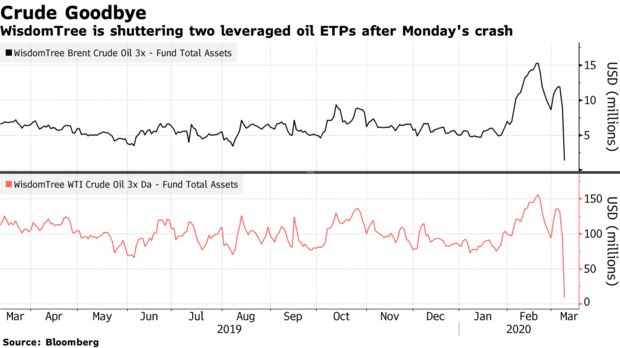

It gets worse…..

The WisdomTree Brent Crude Oil 3x Daily Leveraged and the WisdomTree WTI Crude Oil 3x Daily Leveraged products will both be terminated “due to an extreme adverse move in oil futures.”

Seeya.

When rates are as low as they are right now it gives investors no alternative but stocks. That’s what has fueled this 10- year bull market.

One big positive right now is that as of this morning, 78% of S&P stocks had a higher yield than the 10-year treasury.

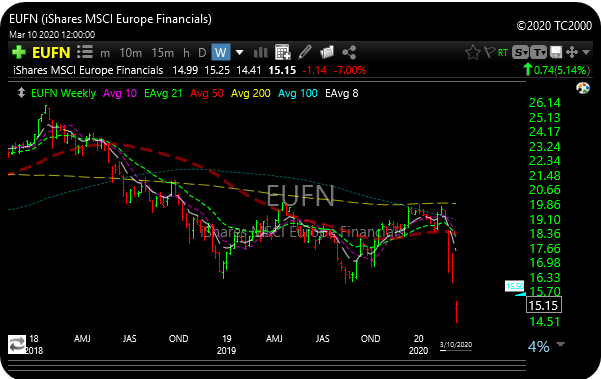

There is immense battle damage out there right now. Remember that perfect double top I showed on the monthly XLF etf chart a few weeks ago? What a train wreck. Rates imploding and then the oil shock has just crushed XLF. By the way, BAC has the most exposure to energy.

You can also stick a fork in the European financials.

We all know about dark pools, algorithms, and black boxes, but the chart below shows what the big boys are doing in this crazy market and it’s actually kind of funny because frankly, I really don’t think they know WTF they are doing.

It’s all about trading long and short gamma, above my pay grade, but good luck to them.

It seems out of every crisis comes new buzzphrases and acronyms. Brexit would be an example, and before that, we saw acronyms like “BRIC’ ( Brazil, Russia, India, and China). You may remember ‘PIIGS” (Portugal, Italy, Ireland, Greece, and Spain). Don’t forget TARP (Troubled Asset Relief Program). “Green Shoots” was constantly bandied about after the 2008-2009 market crash.

The new one now is “social distancing”. Have you heard it yet?

It was spawned by the coronavirus situation (a millennial from the Huffington Post probably coined it), and it simply means you stay home, you distance yourself from society. Hide in the corner until everything passes kind of thing.

We are seeing a lot of events get canceled right now.

Coachella in Cali just got canceled, Pearl Jam just canceled their tour. Do I want to still see a 55-year-old Eddie Vedder sing Yellow Ledbetter anyway? Yeah, I do. The greatest song that makes zero sense.

South by Southwest (SXSW) in Austin just got canceled. That’s a big one.

So will March Madness be canceled? How about baseball’s opening day in about two and a half weeks?

Do you really need to go to Madison Square Garden to watch the Knicks lose again? Maybe just stay home and crack a beer.

Universities and schools have closed and more and more Fortune 500 companies are telling their employees to just work at home.

This will probably all turn on a dime at one point, hopefully, sooner than later, and when it does we should see a rally that can sustain itself for more than a couple of hours or a day.

But for now, it’s just “social distancing”.

I’m fried. See ya tomorrow.