Dow: +117.47…

Nasdaq: +84.92… S&P: +22.57…

Stocks climbed to fresh highs today after a thaw in trade relations between the U.S. and China sparked a rally in shares of technology companies. But as the day progressed, the market’s momentum petered out.

Investors are still unsure whether the talks will affect the Federal Reserve, which has signaled it may cut interest rates in the coming months if the economy weakens further. A series of reports today showed that in June, U.S. factory activity lost some momentum, the U.K. manufacturing sector had its weakest month in more than six years and Chinese manufacturing activity contracted for the first time in four months.

It seems to me that the Fed is still on board even if it’s only a 25 bip cut and not 50 bip cut when they meet at the end of July.

There are still some unknowns as to what the depth and breadth of the USA/China deal will be, but for now, the market doesn’t care.

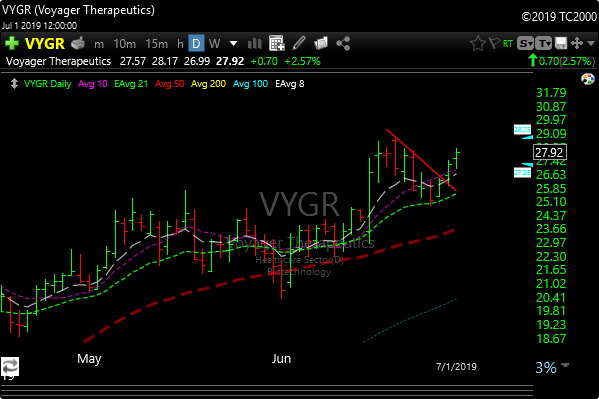

Here are a few good looking charts.

ABM–

DOVA– this one is working off a massive breakaway gap at the 12 level. It’s now bill flagging. This one could do 20.

VYGR-continues to act well

AMD– the semis are smoking again and this one looks good on the buyback.

IOVA – since the massive breakaway in May and subsequent uptrend, it’s now starting a bull flag.

P.S. The gold and silver stocks are starting to retrace so the setups should be better soon.