When the worm turns, love can turn to hate and hate to love with stocks. We have seen the hate turn to love in gold, silver and metals and mining of late. GLD, SLV, copper, and XME.

These dramatic reversals are usually always followed by chasing, and the fear of missing out (FOMO).

The first move is rarely the “real” move though. You see the panic buys, then a pullback. Sometimes the pullback shakes out weak buyers because they have immediate “buyers remorse” from chasing ( they think they goofed) because they top-ticked stuff, so they sell. That is what gives you, the smart buyer, a better entry.

Even steel (SLX) is bouncing, although that sector has faked me out more times than I care to discuss. I think a lot of the future success of steel will depend on infrastructure getting passed and that’s going to be a tough sell. China too.

Crude oil exploded higher as we are evidently on the eve of thermonuclear war with Iran.

China has slipped off the front page a bit lately because we have a Fed that wants to take us to zero rates and nervousness about Iran, drones, the Strait of Hormuz and other geopolitical “stuff”.

This market is so driven by the Fed though, that it shook off all the Iran nervousness quickly. After a selloff, the Dow, Nazzy, and SPX ended up closing at or near their day highs.

We saw some massive breakaway gaps today commodities. I gave you a bunch of these names to watch last week, if you nibbled great, if you didn’t, there is a great shot that you will get another bite at the apple.

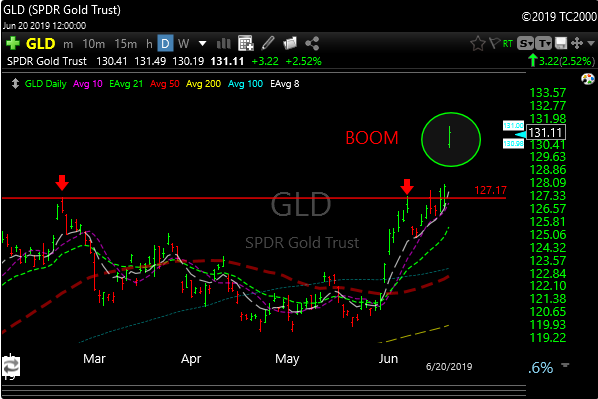

Gold– I talked about the possibility of a double top breakout last week. There you go.

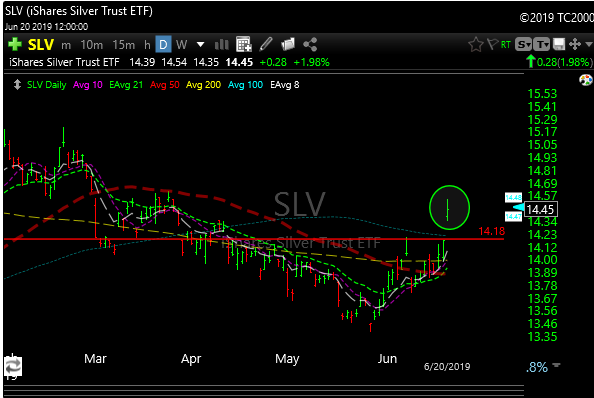

Silver– Breakout after long downtrend and base.

XME- Metals & Mining

After the breakout Tuesday, we’ve seen two high volume follow-through days. Now above the 50-day moving average. Closed poorly today though.

GDX- Gold miners- Massive breakout on 3X normal volume.

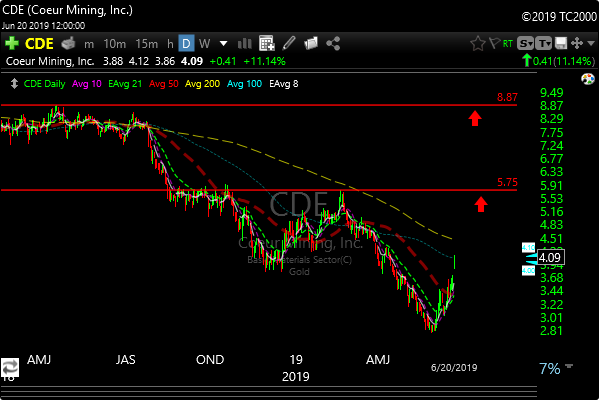

On an individual stock basis, you can just look at some of the names I threw out here recently. CDE, PAAS, WPM, SCCO. All had solid high volume breakouts.

These are potential longer-term targets for CDE just to give you an idea of what some of these names can do longer term.

Gold has moved from about $1270 to $1390 from early June to now, so it should pullback at some point. A move through $1400 should kick off a longer-term target of $1600-1700.

I sold LYFT today. I had a quick trigger finger on this one, but I saw some big volume bars on the sell-side and it closed with a bear flag on the shorter time frames. I may have been a bit hasty but better safe than sorry. It got hit right around the Iran news so I scaled out. The daily chart is still fine. Hope I don’t regret the move.