Dow: +78.74…

Nasdaq: +81.07… S&P: +13.39…

Treasury yields and shares of manufacturers and technology firms rose after President Trump said tariffs on Mexican imports, which had been set to go into effect on Monday, had been “indefinitely suspended.”

Merger Monday happened as……..

United Technologies(UTX) and Raytheon(RTN) agreed to an all-stock merger, valued at roughly $120 billion.

Salesforce(CRM) announced it will acquire Tableau Software(DATA) for $15.7 billion in stock. (grossly overpaid), but that’s symptomatic of how early-stage tech bubbles work.

I receive a lot of research and calls during the day and I am not sure where this came from, but I kind of agree with the thinking (that’s why I am posting it) and its a decent explanation of the scenarios that are in front of us.

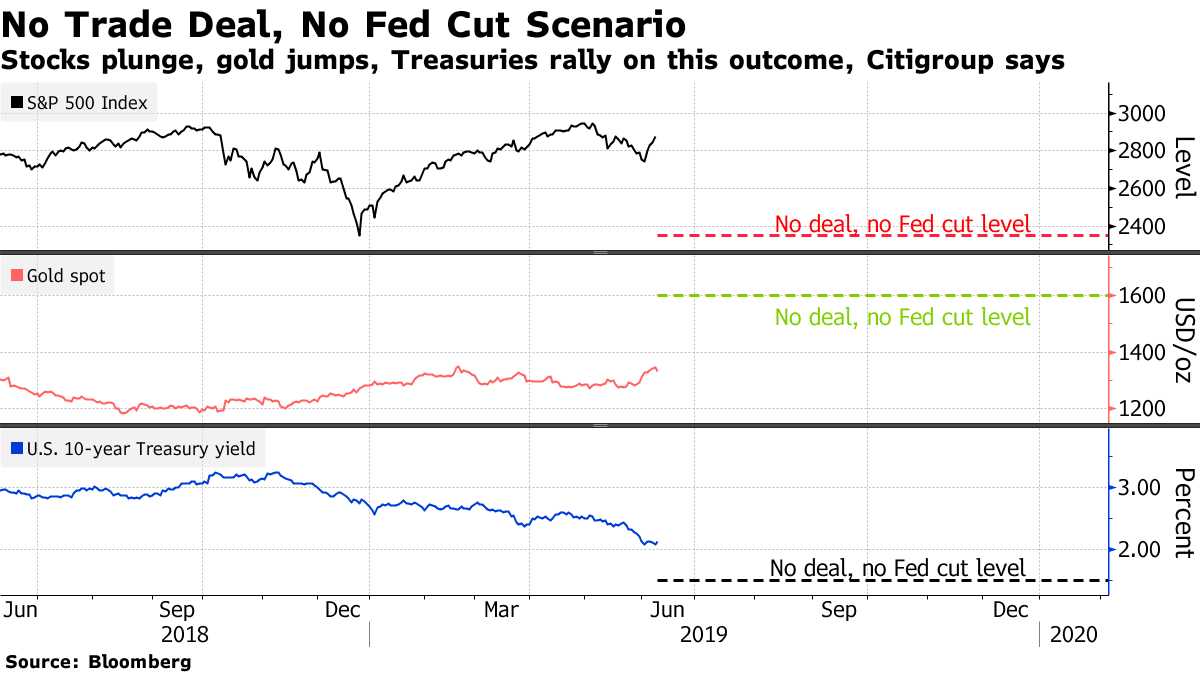

If the Federal Reserve doesn’t cut interest rates, this scenario leaves markets on course for the following:

- A “full-scale bear market” in the S&P 500 Index, sending it 20% down from its April peak, to 2,350

- A tumble in 10-year Treasury yields to 1.50% and “maybe lower”

- A surge in gold prices to $1,600 an ounce, a level unseen since 2013

Or……the landscape “may be transitioning” to a different scenario, with no trade deal forthcoming with China, but the Fed providing 75 basis points worth of rate cuts. That would see new highs on the S&P 500, with 10-year yields as high as 2%. Gold would still gain thanks to a cheaper dollar, with a $1,500 target, the Citigroup team wrote.

Or…..A third scenario has a trade deal at the Group of 20 summit at the end of this month in Japan, where Trump may meet with Chinese President Xi Jinping. Equities would surge, with emerging markets “significantly outperforming.” Yields would rise while gold would slip along with the dollar.

So kinda /sorta a two out of three shot for higher prices. The takeaway is that it really is all about the Fed, just like its all about the ECB in Europe. Japan is already buying its own stock market whenever they have to. Europe is NIRP-ing (negative interest rate policy) already. Things have never been better (dripping sarcasm).

The indexes rallied well today but closed on or near their lows. It needed a rest as we were getting frothy. I would like a further dip.