Dow: -138.97…

Nasdaq: -32.73… S&P: -8.70…

Or are they? I know one thing, as a swing/position trader I’ve grown weary of trading off presidential tweets. It’s great if you are a day trader because the swings are great, but otherwise, its a study in futility and frustration that really just makes you want to sell or cover and go to “all cash” until the bullshit ends.

I don’t need every minute detail tweeted, and I don’t need the talking heads in the White House opining on all the tedious regurgitated minutia. Just tell me the real deal when its done…k?

This is like playing earnings on a stock, you have absolutely no idea what the number will be but you have exposure anyway. It’s 50/50.

Interesting technical day on SPX. I always say that it’s never if, but when, gaps get filled. Look at the red line on the SPX daily chart below. Today on the dip, it filled the March 29 gap almost to the penny. Funny and cool how this happens sometimes. Gap fills can mark reversals. After it filled, the SPX rallied hard. It reclaimed its 50-day moving average in the process.

I wish I could be more helpful and constructive about what tomorrow holds, but it really just comes down to China and the US right now. If you are long you’re nervous, if you’re short you’re nervous, and if you’re both, you’re vaping mass quantities of CBD oil.

By the way, UBER priced their IPO after the close tonight for tomorrow’s trading at the low end of the range at $45. How fiscally responsible of them.

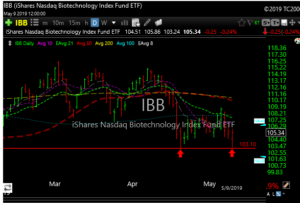

There were some strong reversals off the lows today. LABD went from +10% to close flat as both IBB and XBI bounced almost exactly off their lateral support levels.

The financials KRE & XLF also both had solid reversals off their lows today.

INTC was a disgrace as they guided out three years. I don’t think AAPL even gives “quarterly” guidance anymore, but these jackasses felt the need to tell you how slow things will be a third of a decade away. I never saw this before. This crushed the semiconductors into the close yesterday and INTC specifically. We stopped today at the lower price on my morning email.

This does tell me though that you can short the semiconductors with more confidence on any rallies going forward because INTC is a bellwether. I was only looking for $2-3 on this one, but you can’t control news releases. Asshats.

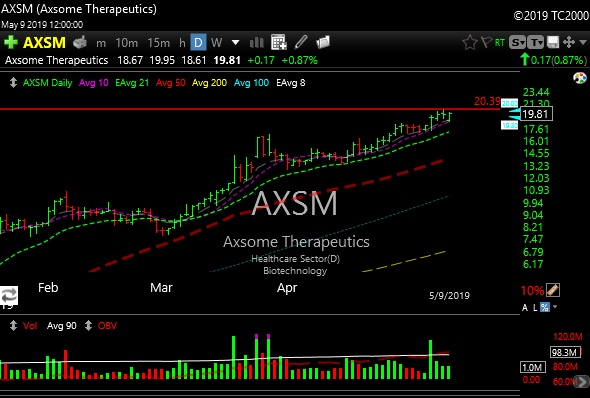

Still one of my favorite biotechs, doesn’t flinch. One to watch.