Dow: -200.91…

Nasdaq: -145.57… S&P: -23.90…

This market is getting smacked around like pinata the last few days. As you know I’ve been queasy on this tape since last Thursday.

I spoke about Europe the other day. The Dow making highs but the Russell breaking down hard, and interest rates ripping higher. Biotech looking vulnerable. Today the VIX was up 20%, it had been up 35%.

If you took almost any of the shorts from the Sunday video you are sitting in high cotton. Exception SEDG, which stopped and made me look stupid. I still think it dies if you’re still short.

Since Mondays open, our short ideas like WB, TRLD, WTW, FCFS, SFLY, GRVY and IIN are rolling over hard and look lower. More are setting up.

Has the market topped permanently? Nah, don’t think so. It needs to pull in every lemming first….and it will.

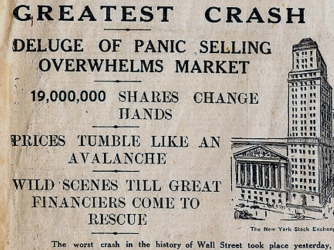

I’ve been trading for 30 years and I’ve been through all those nasty crashes. I asked clients after the 87 crash if they had ever seen a crash. At the snapshot in time, the answer was no, so everyone was pale-faced and looked like they needed a lobotomy.

After the tech bubble crash in 2000 I asked the same question, Some said yes because they went through the 87 crash.

In 2008-09 I asked it again and some answered that they had been through both, (87 and 2000) and many said no, some said “no, I am fairly new to the market but my 401K is now a 101K. I’m broken.”

Its you folks that havet seen one before that I worry about.

94% of mutual funds lost money during the financial crisis crash in 08-09. Mutual funds can’t be short. I can be short and so can you. During that period I did incredibly well. I woke up short and went to bed short. If you follow me, you will be too when the reaper shows up.

My point is that this secular bull won’t last forever. I don’t want to be a Debbie Downer, I’m trying to be helpful here. If you don’t short when you need to; when this market turns to pixie dust, (it will), you will lose most of the gains you have made over this bull run.

Not knowing how to short or refusing to, is like only leaving your house when it’s sunny.

You cant be one dimensional with the stock market, if you are, you are dead. It plays both ways, you must too. To reiterate, 95% of mutual funds lost money in 08-09.

Crashes aren’t pullbacks, they are directional moves that last years. This is when you”short the rip” and you don’t “buy the dip”.

More to come on this topic as we are in year 10 of this raging secular bull. I follow cycles, so should you. We are due at some point. You will get a ton of value here when shit blows up.

These things usually end with a raucous and unbridled blow off top and we haven’t seen that yet. Again, suck in all the lemmings first.

Anyway, hoping for a big rip into year end, we’ll see.

The economy is awesome, better than its ever been, so no short-term Defcon 1 alerts here.

I’m just setting the stage and conditioning you for what will come our way at some point. It will be sooner than later. It will be vicious, it will be unforgiving. Timing? I wish I knew, but I’ll know it when I see it. I’ve seen too many.

Maybe we’ll buy this dip soon, let’s let the dust settle.

Have a great evening now, open up the Jack and have Xanax. We could be up huge tomorrow. It aint ready yet. LOL