Current market

“Everyone has a plan until they get punched in the face”– Mike Tyson

US indices saw early gains give way once again as investors continue to look to the safe haven of US Treasury markets. For once the finger could not be pointed squarely at headlines out of China. The selling was noticeably more aggressive in tone, especially early in the afternoon when the S&P cash market careened through 1,900. The DJ Transports and Russell 2000 continued to lead the way lower and are now firmly into bear market territory. Talk of forced liquidations and margin calls surrounded sizable declines in some of 2015’s biggest winners.

Amazon and Netflix shares were each down over 5% on no apparent news

High yield concerns and the potential energy dominoes yet to fall remains an overriding topic ahead of US bank earnings set to kick off tomorrow. The HYG ETF dipped below $79 for the first time in roughly a month.

Being short is a blast if you get it right and although this may just be a garden variety 10-15% correction, it still brings me back to the halcyon days of 2009 when staying short was quite a payday. I’ve always said that fear is a greater emotion than greed.

You also dont get margin calls on the way up, but you do on the way down, so there’s that.

I do believe here are decent sized hedge funds that are taking a big hit here. This could lead to some closings and liquidations. We’ll have to see, but I just dont see how some of thee guys will walk away, especially “long only” funds that have been buying energy all the way down.

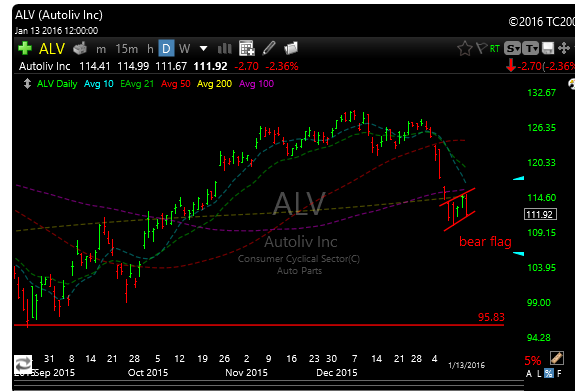

I didn’t do much of anything today, but I did add a new short. It has all the characteristics of a future corpse.

Current P&L

Enjoy some calming tones of Miranda doing an Eagles classic.