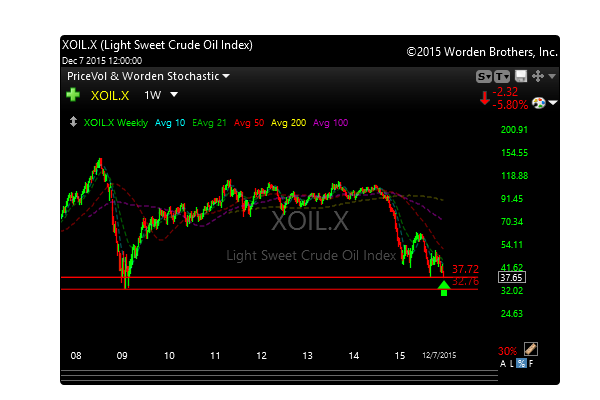

Energy stocks dropped 3.7% today and crude oil dropped 5.8%.

Who knew???????

As I mentioned in last nights video, Thursday and Friday seemed extreme from both ends. Big down, then big up. I thought today would be important because many of the short and long positions probably squared away on Friday to an extent.

The market dropped hard today from the open until about 10:30 when things settled and then pretty much just went sideways for the rest of the day.

Most of the selloff, if not all of it, was due to the drubbing in crude oil and energy stocks. Just a mess. They look horrible and are a big fat AVOID. Do not bottom fish or knife catch this group as they are in LIQUIDATION MODE. The time will come but its not now. Hedge funds and mutual funds still have three weeks to pound these names, so stay away.

Some of the heaviest declines came in the shares of companies with heavy debt loads, which are perceived as the most vulnerable to a further downturn in energy prices amid a historic bust. Many oil and gas companies took on large debt loads to fund domestic drilling projects when energy prices were higher.

If you look at the monthly chart of crude above, a retest of the 2008, 32 dollar level could be tested if this all decides to just wash out.

The next group that could implode here after its dead cat rally (similar to XLE), is the materials sector (XLB). The chart below looks a lot like the XLE chart after its rally and before it imploded.

Click here for XLB chart.

This market is always interesting. Lets see what tomorrow brings. Have a good night.

Tonight’s P&L (also on the P&L tab on the blog)