Today was rough. The morning held some promise, but the the sellers took control as Russia shot down a plane on the Ukraine Russia boarder. There may have been 23 Americans on board. 208 people died.

Hours later, Israel attacked the Gaza strip by land, sea and air. This is all ugly folks and time to chill.

The media is having a blast with this. Its what they do. TURN OFF THE MEDIA IF YOU ARE IN THE MARKET.

The worst is probably over. Most of the time the markets actually rally after war events happen.

The market needs to process this first.

Some technical damage was done today. The Russell 2o0o broke its 200 day moving average. This was big for the bears and if that index wants to keep it together, the bulls need to take that moving average back or the bears will continue to have their way.

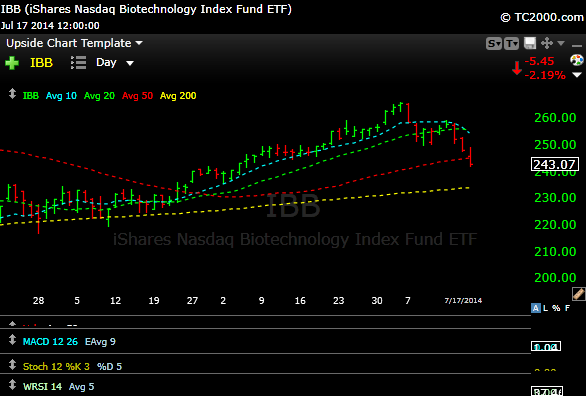

I talk about the biotech sector often because its a risk on sector and its a great indicator of where money is going or leaving. Right now its leaving fast. Check out IBB the etf.

IBB broke the 50 day moving average today and unless it recovers soon it will hit the 200 day moving average. Remember that this sector is part of the Nasdaq and can drag it down. The 200 day ma is around 234. it closed today at 243.

I like corrections like this (I took losses)because its the best time to make my list. It gives you a chance to buy things cheaper. We’re still in a bull market so hang in there. Don’t panic, take losses if you have to. I took losses the last two days and I will tell you tell every move I am making over the next few days. We’re in this together. We need to look at the Russell as it is VERY oversold.

See you early in the trading room. Lets keep the trading room market oriented as best we can, we need all the eyeballs we can get. The key to the trading room is to put eyes on stocks. Its so valuable. You guys have made me money so lets try to keep it about stocks as best we can.

Joe