{+++}

The Nasdaq has been down 6 of 7 days and lost a little over 2% last week. The Dow and S&P were down about the same for the week.

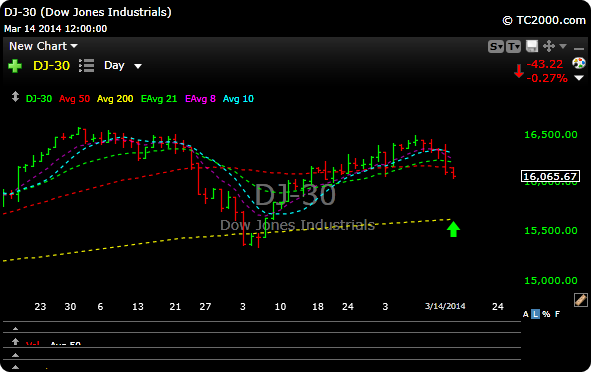

What is interesting and frustrating is that the $SPX, $QQQ and $IWM made highs in January (pulled back in February) and went on to make higher highs in March. Not so much for the Dow. The Dow was not able to participate in those new highs. If the Dow does go back down and test the 200 day moving average (15,619), then that whole V shaped bounce that started in early February was all for naught. Remember that the Dow was the last to catch up to the rally, but now is the first to be rolling over. Granted small caps have been on fire.

It’s cool if Russia takes Crimea, whats not cool is if Putin spreads his wings and wants more of Ukraine. That’s the worry. The market doesn’t know what this ex KGB dude will do, so bids get pulled and everyone walks away. Why bother? Traders would rather get this out of the way and pay up, (I would). Why pick a bottom especially when the technicals are under stress anyway.

All is not lost, and I am seeing a lot of really nice setups that have pulled back. It’s nice to feel that you are not always chasing offers. Buying the pullbacks has been the winning ticket anyway.

1850 then 1841 were my support levels all week and as you know we closed right on 1841. The next big level of support is the 1828 level. Should that 1828 level be breached with volume, than it is possible that the V shaped rally can get retested, back to where it started.

Through this rally, the corrections that we have seen seem to be in the range of 3% to 6%. So if that stays in tact, we may not have that much more to the downside.

What is happening in China is a reality. Slower growth. It’s not a secret now, so it just depends how much more the market wants to discount that. If China will start growing at 6% instead of 7-7.5% then I think our markets will be just fine. The markets always overreact to the downside. The markets are precessing and adjusting to this new data. When markets process information they usually correct.

There are some nice pullbacks out there and I will have some new names over the next couple of day, but it pays to wait another day for things to settle down.

See you in the trading room in the morning.