{+++} For the day the SPX/DOW were +0.75%, and the NDX/NAZ were +1.05%. Bonds lost 16 ticks, Crude slid $1.20, Gold dropped $18, and the USD was lower too. Medium term support remains at 1628 and 1614, with resistance at the 1680 and 1699 area. Tomorrow: the ADP at 8:15, then weekly Jobless claims at 8:30. Then Factory orders and ISM services at 10:00. Also the ECB is meeting prior to the open. Short term support rises to SPX 1648-1649 and SPX 1636-1640, with resistance at SPX 1658-1667 and 1680.

To me, yesterday’s action was bearish. Europe and Asia rallied us (we were closed) then the U.S. came in and sold the rip. Very bearish action, But today the bulls took control again and started buying. Tomorrow’s action may tell us which way we are going. A strong up day tomorrow, for my money, would swing the advantage back to the bulls. Although more chop might be in store as the jobs number is Friday.

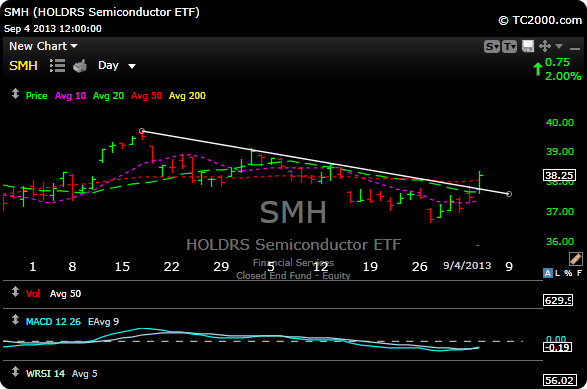

I don’t know if it’s the Apple refresh cycle that’s coming, probably more seasonal, but semiconductor stocks are getting hot. See KLAC, CRUS, MU, SNDK, ALTR etc. The SMH, semiconductor etf broke out of a downtrend line today, so this is a group that may want to run into year end. The MACD ( Moving Average Convergence-Divergence) went positive on SMH today too. Very bullish. I’ll be looking at names in this group over the next couple of days.

I moved all active positions over to the September P&L tonight. See you guys in the morning.