{+++}

This is the period of the market cycle where all the charts look fantastic and buyable. The setups are truly tempting. We’ve had a nice rally and that rally has morphed some crappy looking patterns into winning type patterns.

This can also be the time when the market throws a correction at us. No on expects it , so that’s when it happens. Maybe it will, maybe it wont. Just be careful out there.

Two things will happen here over the next week or two, we go sideways and consolidate before another lag up, or we give some back. As you can see below, the SPX broke above the daily downtrend line tracing back to the 9/14 high, but it still hasn’t taken out that lateral resistance which is the 8/14 high at 1474.61. So we are about eight handles away from it.

Apple continues to act poorly even after its two day oversold pop/short squeeze. GOOG acts better and has become the leader in tech. Apple desperately needs to get over that 50 day daily moving average around 556 or there is a good chance it may start finding its new home in the mid 400’s. I have absolutely no interest in playing Apple other than for a day trade.

1575 is the all time high for the SPX and we hit it on December 12. 2007 and I have a feeling we could come close to that number by year end. Who knows what happens after that, but as long as rates stay low, and regardless of the economy (barring deep recession), I think we get there.

Earning start very soon. I hate trading during earnings. It doesn’t involve much skill, its guessing, and it has tendency to completely remove the natural rhythm of the market, and we have started a nice rhythm. Most people, newer traders especially, get blown up during earnings season, because its just riverboat gambling. The only person that knows the real number is the CFO, so anything else is a guess. I suggest that you avoid playing that stupid game.

Here are some setups I will be watching this week.

ARUN is working a nice pattern a mini bull flag. I would buy the 22.20 level

RHT is working on a base. Buy the 55.42 level.

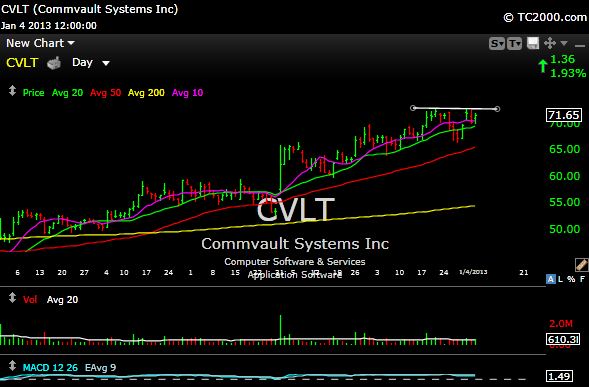

CVLT working within a nice ascending channel and looks higher. Buy the 73 area.

ANN is working on a pretty long falling wedge or down channel, but it is kissing up against the downtrend line, so I would be a buyer in the 34 area.