{+++} I have some technical difficulties tonight with video, so I am putting the new watch list ideas here. Sorry for the inconvenience. The S&P had a sideways week which could just be a pause before a leg higher, or a sign of short term exhaustion. Many stocks appear overextended and although they could lift higher, it would be very healthy if we could get a slight pullback.

The trading month ends Tuesday and January has been a great month for the S&P. I have some hedges/shorts on with TZA, TVIX, FAZ & EPV. and I am holding them.

In the event the market does break further to the upside, I have isolated some longs that I really like. The exact entries and stops are on the P&L on my site. Good luck tomorrow and I promise to get a video posted early in the week.

KGC may have bottomed as gold begins to rally again and the miners look higher. I am getting long the 11.90 level

ACOR may have bottomed out short term and biotech continues to be strong, this one could be a laggard.

CREE has developed a mini bull flag on the daily. Watch for a possible breakout with volume at the 27.48 level.

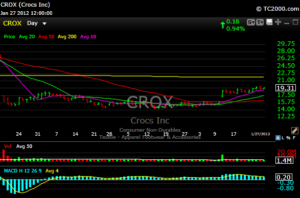

CROX is coiling in what could be a longer bull flag. Watch the 19.71 level with volume to get long.

DTLK is also bill flagging and has broken out of a long downtrend line.

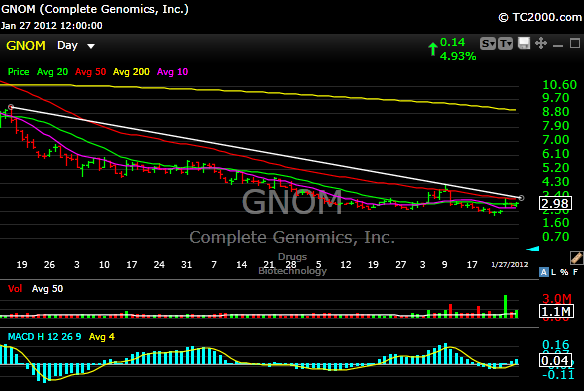

GNOM could get going over the 3.05 level.

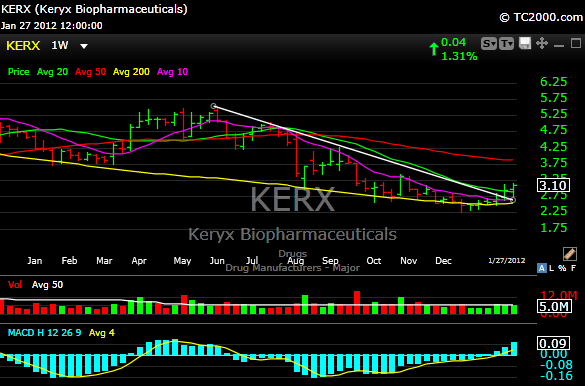

KERX has broken from a fairly long term downtrend line. That is a weekly chart below. Buy at the 3.15 level with volume.

P has been basing nicely and I would be a buyer through 14 with volume.

A reminder, please don’t chase stocks at the open of the market. As you know I like to let things settle for about an hour. I will see you all on the chat room n the morning. Hope you all head a great weekend.