{+++} It was a gap down day, followed by a consolidation followed by a rally that again was led by oil stocks, similar to Friday.

It was a weak day from the long side obviously , but we saw some triggers, most didn’t impress me as volume was stingy.

Some triggers were: SRCL, INFA (strong open, then pullback), GS, AB, GG, ADTN, BLK, PXP, CATY (came close in a downtrend so I triggered) FAZ & OXY which I added intra-day by email.

1286 looks like the new minor support for the S&P, a break there would give way to a quick move to the 1270-1273 level. The game of chess continues. I have one long and one short tonight. Please check the P&L for any adjusted stops or entry prices.

Play it safe and SMALL as the market is in correction.

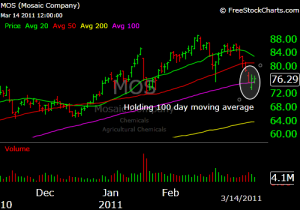

MOS has held the 100 day, (AGU and POT have too by the way) and are short term oversold. I still like the group a lot so check the entry and stop.

AXP looks like it has completed a bearish head and shoulder pattern, it could correct that, but use the trigger to short it.

P.S. I don’t think this SOLAR rally has shelf life.