{+++}

Stocks were hit hard at the open by sellers who were focused on disappointing guidance from Cisco and Akamai Tech, rather than a better-than-expected initial jobless claims report, but the major averages rallied when it became clear that buyers remain in control. Seven of ten sectors were in negative territory, led by energy (+0.9%), telecom (+0.5%) and industrial (+0.4%). Tomorrow before the open look for the following companies to report: BPO, BPL, CCE, DISCA, GLT, GLCH, MDC, SCG, TOT, TRAD, and WBC.

Things didn’t go so well in Egypt today as the expected resignation of Mubarak didn’t materialize. The market ( and the media) will probably get back to their “worse case” pontificating tomorrow and rhetoric will resurface about the possible dangers to the Suez Canal and even the Straits of Hormuz. Personally I don’t buy that argument, but the market has a tendency to hate uncertainty. Oil should do well again and I will be looking for more opportunities in the oil patch. Stay tuned. Tmorrow is Friday (my least favorite trading day) and geopolitics are on the front page so things could get a bit volatile. My suggestion is to trade smaller, that’s what my plan is.

Molycorp (MCP) traded poorly today, mainly because they priced a 15 million share offering after the close. This wasn’t new news, but it put some pressure on the stock. Its the oldest game in the book on these deals, the institutions short stock and then cover on their allocation. The deal was priced at $50 tonight, so hopefully that will be our support on the stock as Morgan Stanley will defend the syndicate bid at $50. I’m still bullish on the name and I remain long .

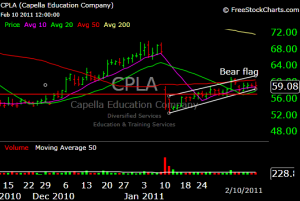

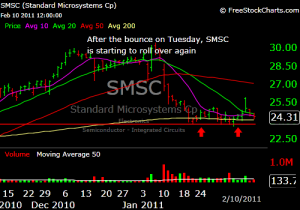

We took some partial profits today on SOHU & MOS and I added POT as a long late in the day via email. Please check adjusted stops this evening on the P&L. Here are some potential short set ups to watch over the next few days.