{+++}

Oil prices opened pit trade more than 1% higher, but some bearish inventory data, which showed a surprise build of 360,000 barrels of crude oil, caused the commodity to give up that gain. Futures prices settled roughly $2 below their session highs at $76.56 per barrel with a 1.3% loss.

After the close, ADS, AFFX, AMLN, BIDU, CA, COHU, CSGP, CVBF, CYS, DOX, EBAY, FFIV, HNI, ISIL, ISRG, KMP, LHO, MKSI, MLNX, NFLX, NTGR, PLXS, QCOM, RJF, SBUX, SFG, SWI, TCBI, TEX, TSCO and XLNX are the only notable names that reported after the close.

Futures are lower after hours with S&P 500 futures 3.56 points below fair value of 1066.36 and Nasdaq 100 futures 1.62 points below fair value of 1816.12.

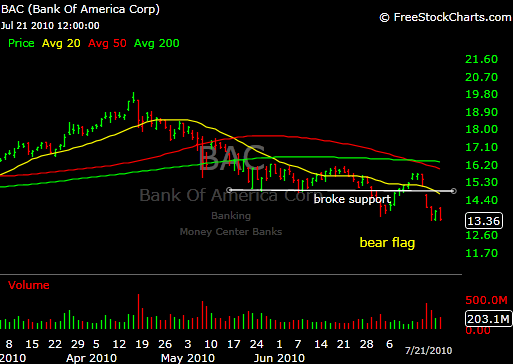

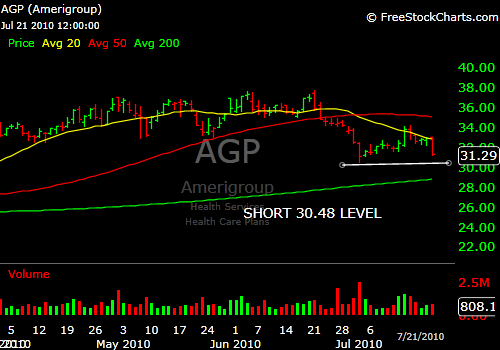

All ten sectors were in negative territory, led by Financials (-1.8%), Consumer Discretionary (-1.8%) and Health Care (-1.5%).

Tomorrow morning, two economic reports are scheduled to be released before the open: 1) Initial Claims (Consensus 445K) and 2) Continuing Claims (Consensus 4600K).

Tomorrow before the open, of the many companies scheduled to report, some of the bigger names include: MMM, AKNS, BBT, CAT, LLY, EXC, FITB, FLIR, KEY, MBFI, NUE, PENN, RS, PCP, SWY, STI, TZOO, TEL, UTEK, UPS, USAK, and ZMH.

The AAPL earnings euphoria from yesterday lasted for about 20 minutes this morning before everything started to decline. This is why I recommend “trying” to avoid the first 20 minutes of trading and today was a good example. If you bought AAPL at the open, you paid mid 260’s and got hurt.

The market chopped around but then Bernanke got about seven words out of his mouth and they released hell on the market. We did well, most folks I spoke to didn’t

I have some shorts on the list because that is what the momentum tells me to do, but knowing this market, we could be up 200 points by lunchtime tomorrow. We will do our best to react accordingly. Hope you had a great day and I wills see you in the morning.

FAVOR..the folks at Stocktwits have been asking me for weeks to get some testimonials for the new site they are creating. If you guys can give me a few sentences about Upsidetrader it would be great. It can be a monetary gain you would like to describe, maybe something you learned, maybe you just like the chat room or just a general comment. You know where I’m going with this. Totally voluntary and if you don’t have time no sweat at all.

Thanks in advance and you can send it along to [email protected]

Here are a few shorts to add to our list. Have a great night.