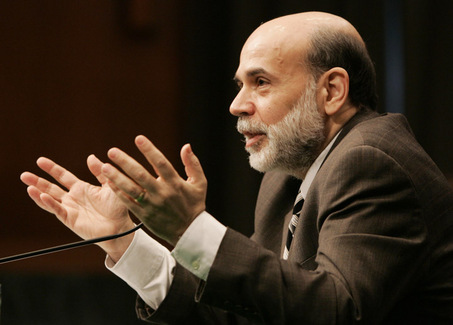

Poor Ben didn’t have a prayer yesterday, as a matter of fact, as the minutes were being read, before Ben even grabbed the microphone, the trap door opened beneath the market.

Poor Ben didn’t have a prayer yesterday, as a matter of fact, as the minutes were being read, before Ben even grabbed the microphone, the trap door opened beneath the market.

There is nothing better than being very short and then the Chairman of The Federal Reserve opines that the economic outlook is “unusually uncertain”. Every week I like to beat a new buzzword or phrase to death, some past winners have been: green shoots, Goldilocks, soft landing, double dip, death cross and head and shoulders breakdown. But I don’t think anything beats “unusually uncertain.”

It just casts so much doubt and uncertainty on a market that is already built on sand. Bernanke said the central bank was willing to do more to spur growth, but he did not elaborate further on what actions the Fed might take.

The market gaps down and rallies, then gaps up and fails miserably. I overheard two black boxes talking at the bar and both were quitting, they said the volatility, even for a robot was too much. All joking aside, it has become rage against the machine as I’ve said all summer. The quants have a field day in thin markets. Pretty easy to “gun” a market when there isn’t anyone around.

I still do things the old fashioned way, inkwell and my pen has a feather on it.

I wrote to subscribers last night that as ugly as yesterday’s action was, a big gap up today wouldn’t surprise me as this market is definitely off its meds. Volatility in crazy town is here to stay.

My Premium Site site continues to navigate these bipolar waters with success. Winners realized yesterday, held one to three days, included: HITK (short) +5.5%, QLD +2.2%, SMN +2.5%, FAZ +5.0%, CF (short) +2%, DRV +1.0%

Chatroom calls from last Thursday resulted in : AAPL +7.00, GS +9.00, CMG (short) +5.00

We’ve been on both sides of this market, many times on the same day, but until we trend, it’s the only way for now. We take stops of course, but we are doing are best to limit risk. If you would like any further information please feel free to e-mail me.

Have a great day. European stress test results tomorrow. Existing home sales today at 10AM EST.