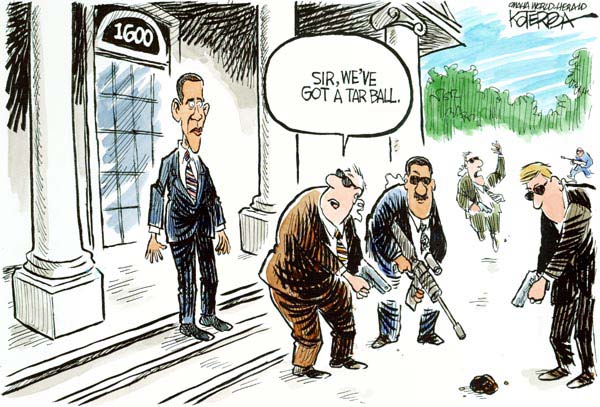

Day 72 is upon us and oil hit some Texas beaches yesterday and consensus thinking is that it will tag the Florida Keys shortly. BP stock has also inched up as they are looking for a strategic investor to shore up some cash. Cute how Libya was the first to pop out of the woodwork.

Europe will give us some bank stress test results today. European stocks were lower as mining stocks dropped and Asia was lower as banks and tech stocks declined. U.S stamp prices are going up but oil is going down and currently trades under $72 ahead of crude data.

It’s hotter than a fox in a forest fire here on the east coast and the market continues to fade as rallies can’t hold. The market for now is still selling the rips and buying the dips has lost some of its appeal.

It’s a thin market and the black boxes can do whatever they want in a thin tape, so expect more fits and starts throughout the summer.

The financials look abysmal and no one has to twist my arm that we will face a double dip, not only in housing but the economy and the market in general. I called for a possible G-Force rally late last week and I’m wondering if yesterday’s wet firecracker was the best the bulls could muster? If it is, then the S&P will have a “9” in front of it pretty soon.

I see bear flags and head and shoulder patterns almost everywhere and the underlying technicals look horrible. Stay tuned as things change quickly around here.

My Premium Site is off to another scorching start for July, as I issued an intra-day long call on Friday. It resulted in profits of 5.2%, 4.3% and 6.5% yesterday as we played various sector ETF’s.

Good luck.