{+++}Well, I was looking for a rally, I even said it may be of the face ripping G-Force variety. What we got was a strong open after overnight futures were lower. We gave up, top to bottom on the DOW, about 100 points. Now we may rally tomorrow, anything is possible and we are firmly in the grips of the summer doldrums, but if this is the best that the bulls could muster after seven consecutive down days, then we may have issues. A rally is still very much in the cards, so we need to stay nimble.

We took gains on TNA, UYM and DRN today and we initiated some shorts in MON, POT, CLF, STD, BLK (stopped) and a long in SMN. I apologize as I missed getting the CLF call out via the e-mail alert, but it hit the chat room.

So many charts are damaged and I see bearish head and shoulder patterns and bear flags almost everywhere. It would have been great for the bulls if they could have held their gains today, but it was very heavy all day and the Russel 2000 was very weak. I’m still not counting a rally out, but if the bulls don’t get something going very soon, there will be a “9” in front of the S&P in short order.

The charts below are for XLF, JPM and BAC. They may be oversold, but bear flags usually pretty accurate as it relates to follow through. I have always maintained that the market has zero chance to put on a serious rally without the banks.

No names tonight as we need to manage what we have for now. Please review adjusted stops and entries on the P&L. If you ever have technical issues with the site, please call the number on the blog. Have a great night.

Retail is under pressure big time, more to go? Sales figures are out this week.

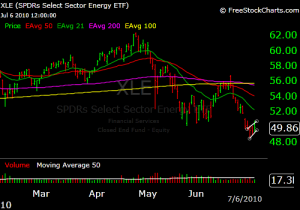

Energy is bearish as anemic global demand sinks its teeth.

The Euro