“I was seldom able to see an opportunity until it had ceased to be one.” – Mark Twain

“I was seldom able to see an opportunity until it had ceased to be one.” – Mark Twain

A really tough two day sell off has been followed by a quick two day buy the dip. We tag 1150 then kiss 1070 in about eight trading days and then grab 30 handles back on the S&P in 48 hours. Brokers everywhere are loving the action as traders try and figure it out. Like lawyers, the brokers always get paid. Over trading? We have an app. for that.

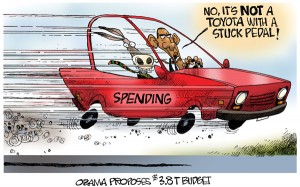

The bank dip was caused by the Volker plan to regulate the evil banks, but now that people realize that Volker is just a tool of the administration to keep Ben and Timmy away from a microphone this week, the fear has subsided. Most in the know now think that the financial reform plan, so feared only a week or two ago, will be now be watered down completely or will just be just D.O.A. Populism hurts markets, and they quickly figure out the real deal. Why so much saber rattling in the first place? Easy, just give the people what you “think” they want to hear. Populism sucks.

So much emotion, so many technical signals right now. So many names broke their respective 50DMA’s, but because of the rally they’ve retaken those same moving averages.

What now? A close below 1099 may put 1070 in play again, a close above 1113 will pass the baton back to the bulls.

Limbo market.