{+++}1030 to 1070 was the range last week and very well could be the range this week. Last week was loaded with events, the Fed, Buffet, unemployment figures, gold hit all time highs and a couple of interesting reversals. Stocks are going up on light volume and down on bigger volume, high/ lows are nothing to write home about, yet the market stair steps higher. Are we close to a vicious fall or will be eclipse the 1100 level with volume this time?

There are two distinct camps right now, the bulls are looking for a huge rally into year end based on vast liquidity on the sidelines (is there really?, mutual funds are pretty spent here), and the bears, well, the bears always think the bulls have had too much fun and should go home early. The bears in my humble opinion have a far better argument and I believe they have far ammo than the bulls do. You know all my reasons by now, but just to name a few; we have 10.2% unemployment, a crashing greenback, tax cuts expiring, tax increases coming, national debt at incomprehensible levels and getting worse, banks not lending, small businesses (biggest job creators) choking, a completely inept government, self serving politicians that are clueless, I could go on forever. The market however continues to climb the wall of worry. And that is what worries me. At some point the party ends and reality does set in.

Here are some names for the next couple of days and the week ahead. I will be on Twitter if we need to change entries or exits, I will also post to the site if I do. Lets have a good week.

| Date | Symbol | Long Price | Short Price | Stop | Action | Result P/(L) | Triggered |

| 9-24-09 | |||||||

| MCO | 23.00 | 22.00 | Covered 1/3

Covered 1/3 Stopped 1/3 |

+2.00

+4.30 +1.00 |

yes | ||

| MHP | 26.19 | 26 | Covered ½,stopped on balance flat | +2.00 | yes | ||

| NAV | 40.31 | 39 | Covered 1/3

Covered 1/3 Covered 1/3 |

+1.30

+3.00 +2.03 |

yes | ||

| QSFT | 16.30 | 16 | Sold ½, sold balance(10-13-9) | +.80

+1.70 |

yes | ||

| SIGA | 8.43 | 7.65 | Stopped | -.80 | yes | ||

| MELA | 10.50 | 9.50 | Stopped | -1.00 | yes | ||

| 9-28-09 | COCO | 17.29 | 18.25 | Sold ½

Stopped 1/2 |

+1.00

-.90 |

yes | |

| ZION | 17.39 | 19.00 | Stopped ½ flat | yes | |||

| 9-30-09 | YGE | 11.90 | 12.60 | -.70 | yes | ||

| VNO | 63.00 | 65.50 | flat | yes | |||

| XCO | 19.05 | 18.00 | stopped | -1.05 | yes | ||

| MHGC | 5.60 | 5.20 | -.40 | yes | |||

| 10-1-09 | CALI | 6.35 | 5.50 | stopped | -.85 | no | |

| CENX | 8.97 | 9.60 | stopped | +.50 | yes | ||

| BAC | 16.02 | 16.80 | stopped | -.78 | yes | ||

| AAP | 37.70 | 39.40 | stopped | -1.70 | yes | ||

| 10-05-09 | EXC | 47.78 | 50 | stopped | -2..22 | yes | |

| JEF | 27.60 | 27.90 | Sold 100% (10-13-9) | +1.60 | yes | ||

| TSPT | 14.35 | 13.70 | stopped | -.65 | yes | ||

| HIG | 29.05 | 28.30 | stopped | -.75 | yes | ||

| APT | 6.25 | 6.00 | stopped | -.25 | yes | ||

| 10-7-9 | FCX | 73.43 | 73.00 | Sold half(10-13-9)

Sold balance10-14-9 |

+1.78

+3.10 |

yes | |

| 10-10-9 | PENN | 25.67 | 26.20 | stopped | -.53 | yes | |

| NITE | 23.00 | 22.40 | stopped | -.60 | yes | ||

| O | 22.85 | 24.00 | yes | ||||

| STEC | 25.51 | 25.80 | Covered 1/3

Covered 2/3 |

+1.00

+3.50 |

yes | ||

| ARST | 23.59 | 24.00 | Sold 1/3

Sold 1/3 |

+1.20

+2.20 |

yes | ||

| FIRE | 23.43 | 22.50 | stopped | -1.90 | yes | ||

| 10-14-9 | HRBN | 19.72 | 19.30 | stopped | -.50 | yes | |

| UCTT | 6.95 | 6.30 | stopped | -.65 | yes | ||

| 10-15-09 | MS | 33.35 | 33.00 | Sold all | +2.00 | ||

| 10-16-9 | QSII | 65.76 | 64.00 | stopped | -1.76 | yes | |

| ACI | 24.22 | 23.20 | stopped | -1.02 | yes | ||

| 10-19-9 | MEE | 33.64 | 34.50 | stopped | -1.20 | yes | |

| BTU | 42.35 | 42.50 | sold | +.20 | yes | ||

| FSLR | 146.80 | 152 | stopped | -5.00 | yes | ||

| ABAX | 23.86 | 25.00 | Covered ½

Covered 1/2 |

+1.00

+1.00 |

yes | ||

| PPD | 40.12 | 41.50 | yes | ||||

| MCO | 23.14 | 25.50 | no | ||||

| 10-22-9 | MCRS | 27.40 | 28.00 | Covered 1/3 | +1.30 | yes | |

| AMAG | 35.10 | 35.90 | yes | ||||

| TNDM | 22.92 | 23.40 | Covered ½

Covered ¼ Stopped 1/4 |

+1.90

+2.30 -.48 |

yes | ||

| BAC | 16.05 | 16.60 | Covered 1/3

Covered 1/3 Covered 1/3 |

+.80

+1.00 +1.50 |

yes | ||

| VMI | 75.70 | 76.70 | Covered ½

Covered ¼ Covered balance |

+3.00

+3.00 +4.00 |

yes | ||

| CMG | 81.13 | 83.00 | Stopped | -1.87 | yes | ||

| ROVI | 28,09 | 29.00 | yes | ||||

| CCL | 30.60 | 31.60 | Covered 1/3 | +1.30 | yes | ||

| 10-30-9 | RTH | 90.00 | 92.00 | yes | |||

| ROST | 43.76 | 44.83 | Stopped | -1.10 | yes | ||

| NIHD | 27.25 | 28.25 | Covered ½

Stopped 1/2 |

+1.90

-1.00 |

yes | ||

| FWLT | 28.12 | 29.00 | Stopped | -.88 | yes | ||

| 11-2-09 | CYOU | 29.00 | 29.80 | Stopped | .-80 | yes | |

| YGE | 11.17 | 11.70 | Stopped | -50 | yes | ||

| JLL | 46.38 | 47.20 | Sold ½

Stopped 1/2 |

+1.30

-82 |

yes | ||

| XHB | 13.70 | 14.30 | Stopped | -.60 | yes | ||

| WFC | 27.40 | 28.20 | yes | ||||

| 11-5-09 | FUQI | 19.14 | 21.00 | no | |||

| CMG | 81.50 | 84.00 | no | ||||

| EXPE | 23.60 | 24.50 | yes | ||||

| 11-9-09 | BBT | 23.83 | 25.80 | no | |||

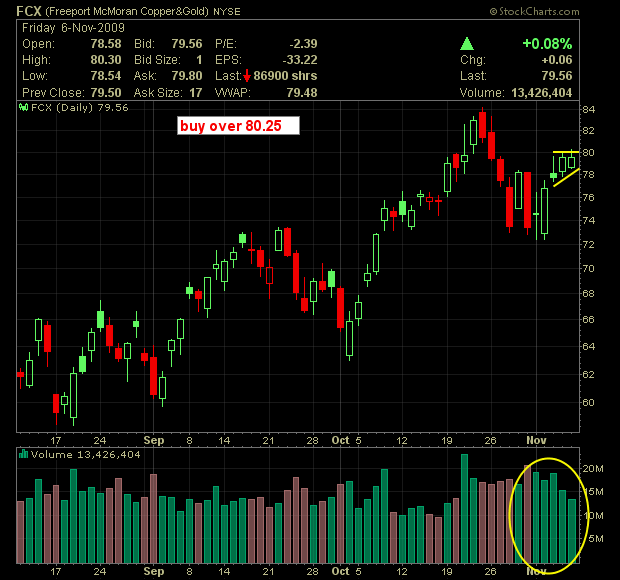

| FCX | 80.25 | 78.00 | no | ||||

| AIG | 32.66 | 34.50 | no | ||||

| KRE | 19.45 | 20.50 | no | ||||

| MEE | 33.68 | 32.00 | no | ||||

| XLF | 13.62 | 14.50 | no |