Sammy the speculator sold all his blockchain stocks and Bitcoin at the bottom and is now hoping for the best with a massive overweight in pot stocks near all-time highs.

Dow: -327.23…

Nasdaq: -157.56… S&P: -40.13…

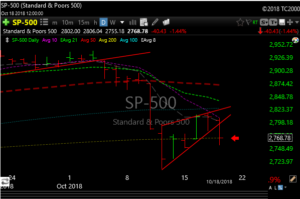

SPX closed right on its 200-day moving average. The Dow and Nazzy are just above theirs. The bear flag on SPX also broke today.

The S&P fell for the ninth time in the last 11 days today, losing 1.4%, as negative global developments killed bids. The index opened just modestly lower, but started extending losses soon thereafter. However, the S&P did close a hair above its 200-day moving average (2768.02), a silver lining on a day hard-pressed for good news.

As for the other major averages, the Dow lost 1.3%, the Nasdaq lost 2.1%, and the Russell 2000 lost 1.8%.

Its bad enough we’re in a tariff tizzy with China, but if you put that aside for a minute the economic news coming out of that place is bad, and it’s scaring our market. One of the reasons the market opened lower and continued lower all day was because China’s Shanghai Composite tumbled 2.9%, extending its yearly loss to nearly 25% and touching a four-year low, amid investor concerns over slowing economic growth.

Rough year for the Shanghai

In case you haven’t checked out India lately, here you go. The analysts told us India was on its way to surpassing China at the beginning of the year. I hope their year-end bonuses are based on these value-added calls.

Emerging markets also found their way to the woodchipper this year. Ugly and still looking lower, especially if rates and the dollar keep going up.

Don’t get me started on Europe, they’re a heartbeat away from chipping off into the Meditteranean. Think its bad now in Europe? Let’s chat in 18-24 months.

Bottom line, we have been the only game in town and every once in while when the rest of the world keeps coughing, we catch a cold. I think folks are looking at how bad things are around the globe (global slowing) and feel in a way that it eventually will filter down to us. Not contagion, we’re too strong now, but still a cold. Sometimes colds can last a few weeks. Investors have been throwing out the global stocks, so eventually, the money will flow back to us, right now mutual funds are seeing some pretty serious outflows, but that always happens with pullbacks and it usually changes on a dime.

Today’s action was ugly and it is possible now that we could go down and test last weeks lows. In my opinion, that will be a blessing if it happens because printing a nice double bottom on the indexes would be a great place to lay some wood and make an aggressive directional bet on the long side. But the market never gives me what I want so it will probably rip higher tomorrow and make it even more difficult to gain conviction.

These oversold rallies can be vicious and it makes it almost impossible to resist the urge to buy. FOMO and greed kick in and you start acting like a tweaker in a meth lab. It’s human nature. You don’t have to be long all the time.

I realized today that I don’t have any longs on the P&L. I have one short. I have no problem being in cash while the algo’s figure out how they want to try to screw me next.

I know I’m a broken record but stay patient. The turn could come at any point……and you still won’t know if its the bottom.

I received about 40 emails from guys I respect (professional traders, specialists etc..) that have been in the market forever. Half were bearish and half were bullish. What am I supposed to do with that???????

Just watch the action. This is just a pullback and it will sort itself out.

$DJIA $SPX, $NDX, $IWM $EEM $EUFN