Dow: +238.51…

Nasdaq: +114.94… S&P: +27.54…

The market was better today as the bulls pulled us out of this slow bleed over the last week.

The greenback ripped today, but the yield on the 10-year backed off.

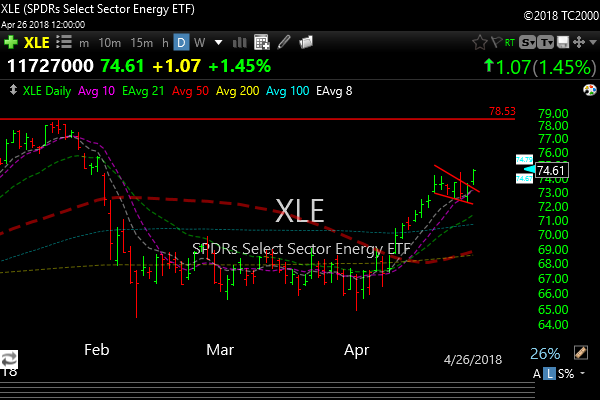

The clear leader now is energy (XLE +1.5% today), but tech (XLK +1.8% today) was the standout today helped by a big earnings report by Facebook (FB) and a reversal higher in GOOGL. Also, AMZN just reported a big number after the close and its up about 100 points right now in aftermarket trading, so this should definitely help things tomorrow. NFLX also has had a nice reversal and is up a quick 20 points from yesterdays lows.

So the bottom line is that for now at least, the FAANG stocks may be seeing a reversal to the upside.

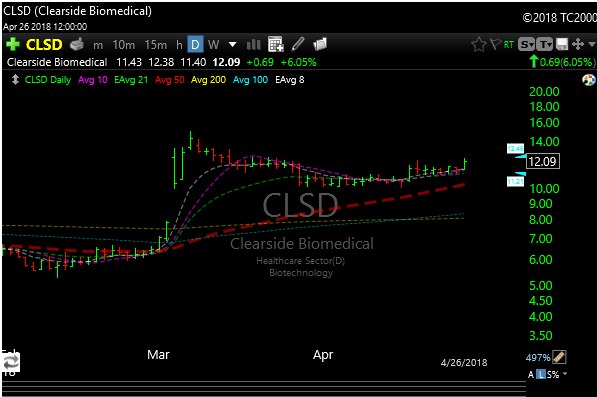

I added a new long today, and you may remember it was highlighted in the Sunday video.

CLSD has acted well through a very trying market and it has been in a bullish coil since its big breakout on March 5. I am looking at 13.50-15.00 as initial targets.

Energy (XLE) continues to look excellent, both the actual commodity (USO) and the energy stocks. A decision on the Iran deal is to be released on May 10. If the deal is undone or changed dramatically it could have a huge impact on the price of oil.

If the deal is revoked, it could cause a stoppage of 300,000 to 400,000 barrels a day out of Iran. Oil (the commodity), and XLE would certainly spike on that and the 75 a barrel level comes into play pretty quickly. XLE looks ready for a move to 79-80. Today it popped out of a five-day long bull flag.

The SPX, DOW, and Nasdaq have all lost their 50-day moving averages. The Russell is still above it so there is still a lot of work to do.

If energy can stay glued together, watch SLCA. It gets hot with energy and it has been beaten to death, but it may be ready to start a sustained move higher.

Looking for more names in energy.

See you in the morning.