The market ended the Wednesday affair on a slightly higher note as the major averages rallied in lockstep with crude oil. The major averages were able to shake the early weakness after the Department of Energy’s weekly inventory report showed a smaller than expected crude oil build (2.08 million barrels; consensus 2.40 million barrels).

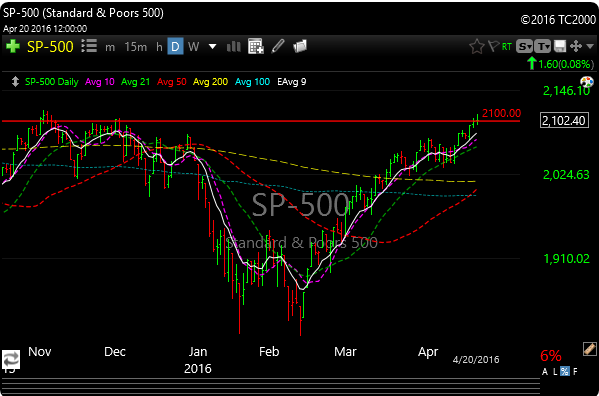

As a result of the rally in crude oil, the SPX managed to break out above yesterday’s high (2104.05) before notching a new intraday high for 2016 (2111.05). However, the market pulled back in the final hour of trade as investors looked ahead to tomorrow’s policy statement from the European Central Bank and subsequent remarks from ECB President Draghi. Five sectors ended the day above their flat lines as financials (+0.9%), energy (0.8%), health care (+0.6%), and technology (+0.2%) topped the leaderboard.

The chatter around town is that Draghi, in true financial engineering form, is ready to for another big bazooka if needed at the end of the summer.

Its interesting to note that defensive groups like utilities (XLU) and consumer staples (XLP) are staring to break down. These are defensive sectors and could mean that we are getting read for another leg up.

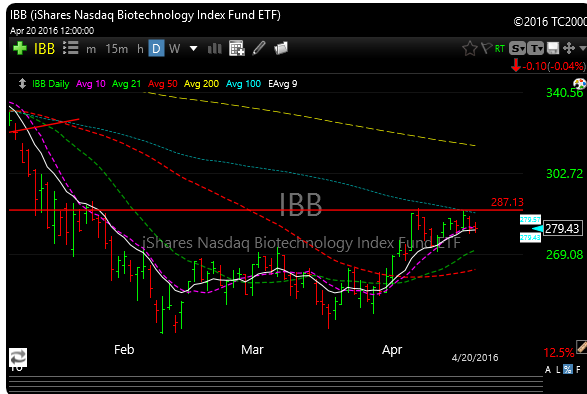

Biotech (IBB) has been consolidating since its breakout back on April 6. The 287 area is the level to watch.

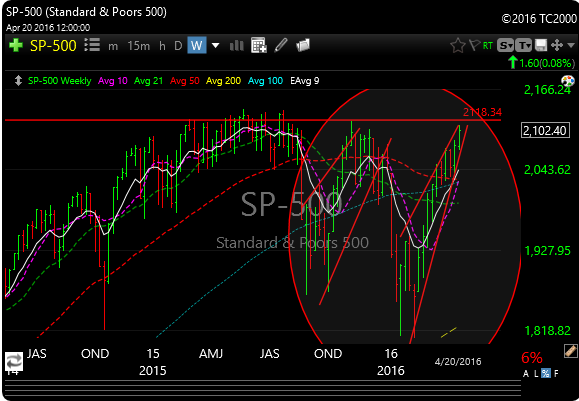

This pattern is back again, the next 2-3 weeks will surely be interesting.

Metals, mining along with energy has been on fire as you know. Here are couple of stocks to watch with great setups.

ATW– possible cup and handle breakout setting up.

SLCA– If Silica is yuor thing then you may like this one. Targets 28-32