The kid who inherited some money from his rich uncle in the oil business slaps it all in a stock mutual fund back in early 2009. After back packing through Europe the last five years, he comes home and looks at a newspaper for the first time and sees that he’s up maybe 150%. He says, “wow that was easy , he puts the backpack on again and heads back to Europe.

Buy and hold became a hated approach, but its all about your entry. I’d give a left kidney to have done the same. Buy and hold became a despised strategy when the market crashed, but not so much now. If you got really long in 2007 you paid the price, if you got really long in early 2009 and forgot about it, your rich. Yep, timing really is everything.

They named a street sign after this market this year…. One Way

Here are a some sectors and stocks to consider for 2014. Although our market had a phenomenal year, there are still parts of the world that are oversold and may see positive action in 2014, especially if the U.S. can show some decent signs of economic life going forward. If you remember, Europe was on the brink of extinction the last couple of years, but if you look at the ETF’s over there, the rebound was amazing. See $EWG, $EWP, $EWI and $EWQ. Some of those countries still have +20% unemployment and debt that could choke a horse. More proof that markets can trade separately from underlying fundamentals much of the time. Side note: I think the Europe move is probably long in the tooth at this point.

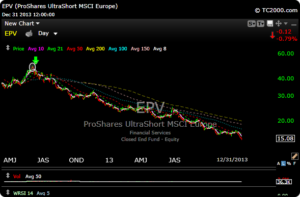

As you can see below, if you were long $EPV which was the ETF that got you short Europe. it didn’t end well. This was a hot ETF in the early stages of Europe’s predicted demise, but then when folks decided that printing money was the answer, Europe ripped higher and this name got pulverized.

Anyway here are a few themes/ideas for 2014.

$EEM – The camp may be split on this, but a rising tide does have a tendency to lift all boats. Even if the U.S. trudges along with tepid growth and if the $SPX does say 7% this year, I can see fund money coming after this asset class. A move back to the 2011 then 2007 highs wouldn’t surprise me by year end, which would be a +25% return.

$IFN– India is approaching big downtrend resistance on the weekly chart. I think the upper 20’s is an attainable target by the end of the year.

$GLD– I was never a fan of gold and when I trade it I have a tendency to do it poorly, but the safe haven motto is garbage in my opinion as the planet threw the kitchen sink at the markets and it just cant get out of its own way. The directional move in rates is higher and for now inflation just isn’t an issue. Gold will show some flashes of brilliance from time to time on a trading basis, but in my opinion it will just be a reason to sell.

I still think healthcare/biotech is in a sweet spot and although very extended, will be great buys on pullbacks. Stocks like $CELG have 17-18 bucks in earnings power over the next couple of years, so you do the math on where it could trade. Stick with that one, as well as $BIIB, $GILD and $REGN. Also dont be surprised to see some big takeover action in this sector.

$NFLX– Something tells me this stock will still surprise to the upside. Hollywood not only loves the company, but needs them. Original content plays a huge part going forward.

$GOOG can probably tack on another 10-15% this year after a pullback.

$AAPL- I can see mid 600’s, but it really needs to stop leading from behind and “wow” us again.

$SPX– is at the top of a long uptrending channel, if its going to correct (it always does) it should be here or slightly higher. A correction will be a great buying opportunity though. We could pull back to 1700 (where the uptrend line is) and it would still be in a picture perfect bullish channel. 2050 could end up being a target for year end.

Hopefully we can move on from the incessant chatter about taper, but we will always find a wall of worry to climb. Lets not forget midterm elections and other things. It seems that Washington always does the most damage.

Have a great year.

Subscriptions here .

Hope to see you as a member this year.