This stage of the market is really one of disbelief in my opinion. It seems to go higher everyday as most just watch. It’s been a record 177 days since the market has corrected 5% . By the way, Tuesday is the best day of the week ,as we have seen 17 straight up Tuesdays. In 1968 we saw 24 “up” Tuesdays in a row.

Corrections can happen in two ways, “price or time”. Meaning that we don’t necessarily have to pullback hard to shake out weak hands. It can just settle and consolidate constructively over mini time frames. Of course the market can get hit hard and pullback, I’m just saying that that isn’t the only way we can consolidate gains.

Hedge funds aren’t close to keeping up with the benchmarks and many chief investment strategists at the bulge bracket firms still have $SPX 1350-1450 targets by year end. As an example, I watched the chief equity strategist at Wells Fargo get interviewed yesterday. She has been at a 1350 S&P target since January and sticks by it. She seemed nice, but seemed better qualified to manage your local bank branch. Her 401k is probably jammed with her own Wells Fargo stock, but she has probably never bought a stock. I’m rooting for her.

I’m neither a Pollyanna or a perma bull, but I know when you need to be long stocks. You are fighting an epic global market manipulation to do otherwise.

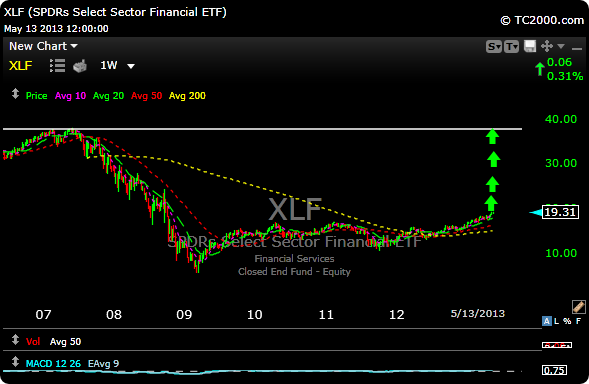

So if you think you missed the move you really haven’t. To give some perspective on this, look at the chart of the financials below. Yes the banks have moved, but they aren’t close to where they probably will be.

My best advice is not to chase stocks that have already ripped, but do your homework and focus on set ups that haven’t even started to move but are developing technically. Good trading.

To request my performance go here

To sign up, go here