There are so many things to write about today, the market at new highs (who isn’t taking about that?), Israel bombing Syria, the Knicks, pop culture had a big week and Warren Buffett will probably get the markets all bulled up Monday because his annual Omaha get together is today. I really want to write about how the Mets and the Jets are the worst organizations in professional sports, but I’ll leave that for another day.

So, I’ll talk Japan. No it’s not a crowded trade, yes you can still make gobs of money there over the next sixteen or so months. Yes, Kuroda, the governor of the Bank of Japan is a crack head like Bernanke and will print and buy things until he falls to his knees from exhaustion.

Reinflating inflation is still all the rage, and the global economy is on board with both hands. Even Putin wants stimulus. I remember when Bernanke first started QE, conceptually the critics were everywhere, but the market loved it. The tape has basically doubled as a result. None of us know what the longer term effects will be, but it’s an instant gratification market and we love just living in the moment and watching the market go higher on a daily basis.

A few weeks ago, Kuroda, the new governor of the Bank of Japan, made some powerful (insane?) statements. Everyone knew he was going to say a few things, but what he said was game changing.

Everyone knew he would get more aggressive with QE, but………………………..

He promised to double the size of Japan’s monetary base by the end of 2014. He will buy not only JGB’s (Japan government bonds), but also equity ETF’s, and REITS. All in, he will be buying 190 BILLION of assets each month (in U.S. GDP terms). This amount completely eclipses what “The Bernank” is doing with his “paltry” 85 BILLION per month.

So there is your thumbnail sketch, you know most of this already, but sometimes the most obvious trades work, and work big. It’s the second inning in my view, even though there has already been a big move in the Nikkei ($NKY) and a decent drop in the Yen ($USDJPY)

A few weeks ago I put on a trade for my subscribers. This is not a flip, and it is geared for a longer term hold.

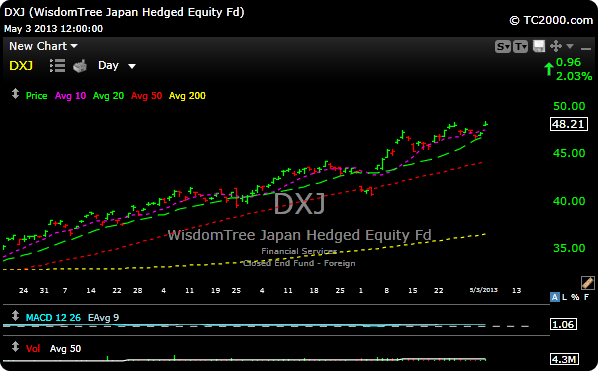

We are long two things, one is an ETF that gets you long the very best Japanese blue chips, (emphasis on exporters) and an ETF that gets you short the YEN. Here are the charts.

$DXJ– This gets you long Japanese equities with an emphasis on exporters that will do well with a falling yen. It also hedges the currency, so you will see more volatility in this than say a long position in just $EWJ. The Nikkei has a shot at 15, 16, 17,000 over time. This gets you a seat at the table. You can wait for a pullback, or nibble here. I am not as concerned with a perfect entry here because my duration is longer term.

$YCS – Bottom line, this gets you short the Yen.

If you want real time updates on this trade and others, or want to request performance and get a free trial, see below. Have a great weekend.